For income investors, it’s always relevant to periodically assess the prevailing yields across different asset classes. The macroeconomic environment is constantly shifting, and so are the yield dynamics of various investments in response.

For example, during a recession, companies may cut dividends, while credit spreads widen as investors demand higher compensation for lending to riskier borrowers.

Meanwhile, if real estate takes a downturn, Real Estate Investment Trust (REIT) prices may fall, driving up their yields as property values decline and rental income comes under pressure.

With the first quarter of 2025 coming to a close, here’s a high-level look at where the benchmarks for three major asset classes currently stand in terms of yield potential.

U.S. Equities

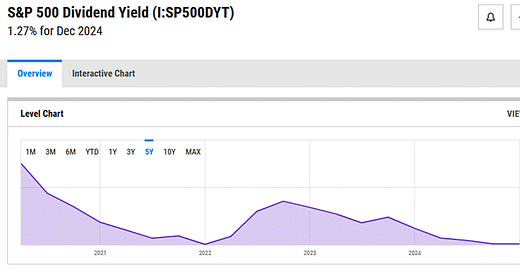

Even with the recent market correction, the S&P 500 remains richly valued, and it’s no surprise that as of December 2024 the index’s dividend yield sits at a five-year low of 1.27%.

Beyond just rising share prices, the structural makeup of the index has played a key role in suppressing yields. The S&P 500 has become increasingly concentrated in mega-cap tech stocks, which dominate the top holdings.

These companies prioritize reinvesting in research and development (R&D) and share buybacks rather than returning capital to shareholders through dividends.

This shift in corporate capital allocation has contributed to historically low yields for U.S. equities despite strong overall market performance.

10-Year U.S. Treasury

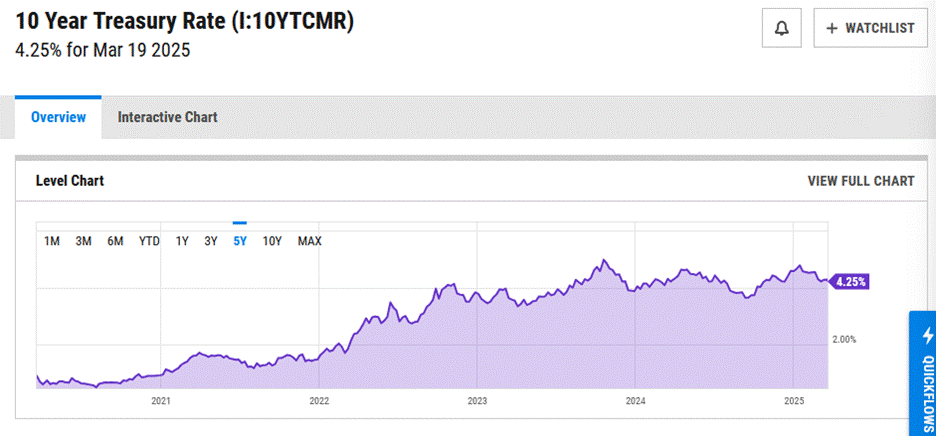

Over the past five years, the 10-year Treasury yield has been on a steady upward trajectory, reflecting a higher-rate environment compared to the ultra-low yields seen in the aftermath of the pandemic. At 4.25%, the current yield serves as a critical reference point.

The 10-year Treasury yield is widely considered the "risk-free" rate, making it a key input for valuing markets and individual securities. Many analysts use it as a baseline for discounting future cash flows, meaning a rising yield raises the hurdle rate for investments to be considered attractive.

While today’s rate isn’t near historical highs—the 10-year yield peaked at 15.84% in 1981 when then-Fed Chair Paul Volcker aggressively hiked interest rates to combat runaway inflation—the key takeaway is that this yield sets the floor for expected returns across asset classes.

BBB Corporate Bonds

The ICE BofA BBB US Corporate Index serves as a key benchmark for what is considered investment-grade debt, representing the lowest rung of investment-grade bonds before crossing into high-yield (junk bond) territory. As of March 18, 2025, the index yield sits at 5.41%, a level last seen during the COVID-19 market sell-off in March 2020—exactly five years ago.

This benchmark matters because it provides insight into how much compensation investors demand for lending to companies with moderate credit risk. BBB-rated bonds are issued by firms that are financially stable but not immune to economic downturns, making them a bellwether for corporate borrowing costs.

Interpreting this yield intelligently means looking beyond the number itself. A higher BBB yield could signal increased default risk, tighter lending conditions, or an economic slowdown, while a lower yield suggests strong corporate fundamentals and easy access to credit.

Looking Beyond the Basics

Income investors can use the 10-year Treasury yield, BBB corporate bond yields, and the S&P 500 dividend yield together as a “first look” when evaluating yield-generating strategies.

These benchmarks provide a baseline for setting expectations on returns and assessing whether higher-yielding assets offer sufficient compensation for the additional risk.

For example, REITs, Master Limited Partnerships (MLPs), preferred stocks, and options-based income strategies typically provide a yield pickup over these core assets.

However, the degree of that pickup can vary significantly based on factors like economic conditions, credit risk, and market volatility.

By keeping an eye on these three foundational yields, investors have a reference point to determine whether they are truly being compensated for the risks they are taking—or simply reaching for yield without enough reward.

About Us

Jay D. Hatfield is CEO of Infrastructure Capital Advisors and is the lead portfolio manager of the Infrastructure Capital Bond Income ETF (NYSE: BNDS), InfraCap Small Cap Income ETF (NYSE: SCAP), InfraCap Equity Income Fund ETF (NYSE: ICAP), InfraCap MLP ETF (NYSE: AMZA), Virtus InfraCap U.S. Preferred Stock ETF (NYSE: PFFA), InfraCap REIT Preferred ETF (NYSE: PFFR) and private funds. Each month Infrastructure Capital hosts a monthly economic webinar; you can sign up to attend by visiting our website www.infracapfunds.com (important disclosures can also be found on the website). For a prospectus please reach out to us or visit the links above for each respective fund.

DISCLOSURE

This information is not an offer to sell, or solicitation of an offer to buy any investment product, security, or services offered by Jay Hatfield, or Infrastructure Capital Advisors, LLC, (“ICA”) or its affiliates. ICA, will only conduct such solicitation of an offer to buy any investment product or service offered by ICA, if at all, by (1) purported definitive documentation (which will include disclosures relating to investment objective, policies, risk factors, fees, tax implications and relevant qualifications), (2) to qualified participants, if applicable, and (3) only in those jurisdictions where permitted by law. Jay Hatfield or ICA may have a beneficial long or short position in securities discussed either through stock ownership, options, or other derivatives; nonetheless, under no circumstances does any article or interview represent a recommendation to buy or sell these securities. This discussion is intended to provide insight into stocks and the market for entertainment and information purposes only and is not a solicitation of any kind. ICA buys and sells securities on behalf of its fund investors and may do so, before and after any particular article herein is published, with respect to the securities discussed in any article posted. ICA's appraisal of a company (price target) is only one factor that affects its decision whether to buy or sell shares in that company. Other factors might include, but are not limited to, the presence of mandatory limits on individual positions, decisions regarding portfolio exposures, and general market conditions and liquidity needs. As such, there may not always be consistency between the views expressed here and ICA's trading or holdings on behalf of its fund investors. There may be conflicts between the content posted or discussed and the interests of ICA. Please reach out to the ICA for more information. Investors should make their own decisions regarding any investments mentioned, and their prospects based on such investors’ own review of publicly available information and should not rely on the information contained herein. ICA nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. We have not sought, nor have we received, permission from any third-party to include their information in this article. Certain information contained in this document constitutes “forward-looking statements,” which can be identified by the use of forward-looking terminology such as “may,” “will,” “should,” “expect,” “anticipate,” “project,” “estimate,” “intend,” “continue” or “believe” or the negatives thereof or other variations thereon or other comparable terminology. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking statements.

The information contained herein represents our subjective belief and opinions and should not be construed as investment, tax, legal, or financial advice. Investors should consider the investment objectives, risks, charges, and expenses carefully before investing. Please read the prospectus carefully before investing. For more information about the Fund, Fund strategies or Infrastructure Capital, please reach out to Craig Starr at 212-763-8336 (Craig.Starr@icmllc.com). The Funds are distributed either by Quasar Distributors, LLC or by VP Distributors, LLC, an affiliate of Virtus ETF Advisers, LLC. ICAP, SCAP, and BNDS ETFs are distributed by Quasar Distributors LLC. PFFA, PFFR, and AMZA ETFs are distributed by VP Distributors, LLC an affiliated of Virtus ETF Advisers, LLC.