When evaluating income investments, dividend yield and dividend growth tend to get most of the attention. But equally important, if not more so, is dividend sustainability. In other words: is the company likely to keep paying, or is there risk of a cut or suspension?

The go-to metric for gauging that risk is the payout ratio, typically calculated as dividends per share divided by earnings per share (EPS). A high payout ratio may signal trouble if a company is returning more to shareholders than it’s earning.

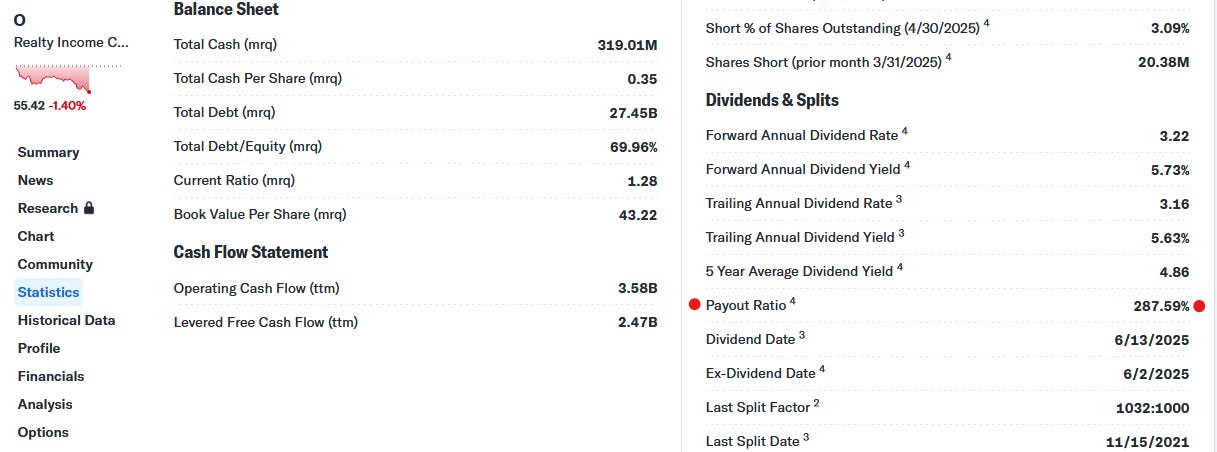

But this formula falls short when applied to real estate investment trusts (REITs). For example, investors who look up Realty Income (O) on public platforms like Yahoo Finance might see payout ratios north of 100%. That looks alarming, but it’s not necessarily a red flag.

The issue lies in the structure of REITs and how their earnings are reported. Many data providers don’t adjust for the differences, which can distort the true picture of dividend coverage. Here's how to properly assess the sustainability of a REIT’s payouts using the right metrics.

Why AFFO, Not EPS, Is the Right Lens for REITs

REITs don’t operate like traditional companies, and they don’t report or rely on EPS the same way either. Instead, the key metric used to evaluate a REIT’s true earnings power is adjusted funds from operations (AFFO).

AFFO is a non-GAAP figure that varies slightly by REIT, but it generally starts with funds from operations (FFO), which adds depreciation and amortization back to net income, and then subtracts recurring capital expenditures and straight-lining of rents.

In simpler terms, it reflects the actual cash a REIT has available to pay dividends, after accounting for the maintenance and upkeep needed to keep properties generating income.

Industry experts consider AFFO a more accurate measure of a REIT’s ability to sustain its dividend because it better captures the recurring, cash-based nature of their business.

Unlike EPS, which includes non-cash items like property depreciation and gains or losses on asset sales, AFFO focuses on what really matters: reliable, repeatable cash flow.

Revisiting Realty Income's Payout Ratio

According to Yahoo Finance, Realty Income shows a payout ratio of 287%. That figure is clearly misleading. It suggests the company is paying out more than twice what it earns, which would raise serious questions about dividend sustainability.

But that number is based on EPS, which, as mentioned earlier, is not the right benchmark for REITs. When you look at AFFO, you get a much clearer picture.

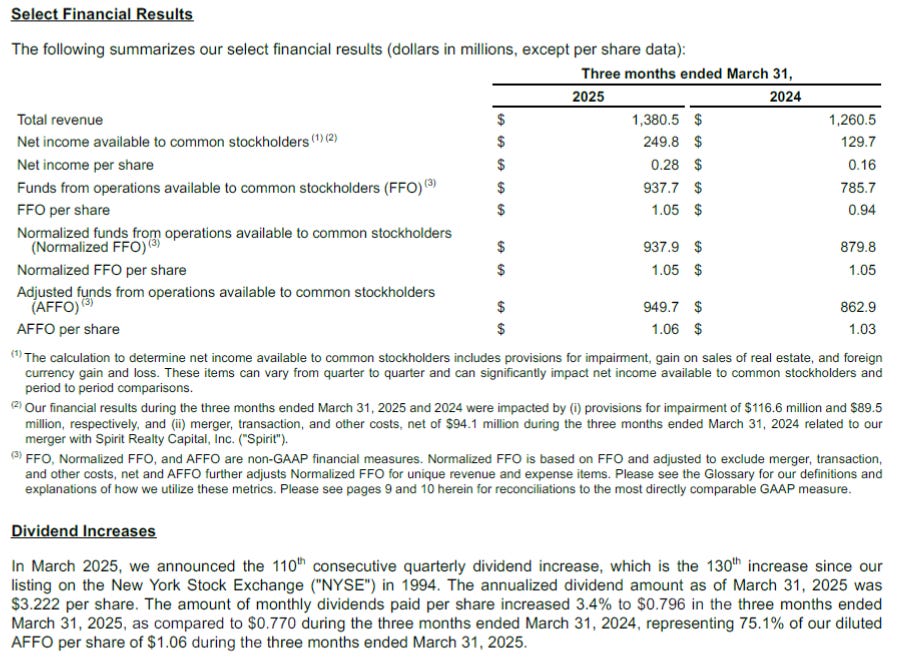

In its most recent quarterly earnings for the three months ended March 31, 2025, Realty Income reported AFFO per share of $1.06. During that same period, the company paid $0.796 in monthly dividends per share. That equates to a payout ratio of 75.1% of AFFO.

This number is far more reasonable and paints a realistic picture of dividend sustainability. A payout ratio in the 70–80% range is typical for well-run REITs and leaves room for reinvestment and operational flexibility.

It’s also worth noting that this marks Realty Income’s 10th consecutive quarterly dividend increase, and its 130th increase since listing on the NYSE. That kind of track record doesn’t come from stretching to pay unsustainable distributions.

Look Beyond the Headline Numbers

The key takeaway for income investors is this: don’t take headline payout ratios at face value, especially when evaluating REITs.

Metrics like AFFO are better suited to assess dividend sustainability because they reflect the actual cash available to pay shareholders. Realty Income’s true payout ratio is closer to 75%, not 287%, once you use the right lens.

The same principle applies to other capital-intensive sectors like pipelines and utilities, where non-GAAP metrics such as distributable cash flow (DCF) often provide a more accurate view of how well dividends are covered.

Remember to always dig a little deeper to understand what’s really backing those monthly or quarterly payouts.

About Us

Jay D. Hatfield is CEO of Infrastructure Capital Advisors and is the lead portfolio manager of the Infrastructure Capital Bond Income ETF (NYSE: BNDS), InfraCap Small Cap Income ETF (NYSE: SCAP), InfraCap Equity Income Fund ETF (NYSE: ICAP), InfraCap MLP ETF (NYSE: AMZA), Virtus InfraCap U.S. Preferred Stock ETF (NYSE: PFFA), InfraCap REIT Preferred ETF (NYSE: PFFR) and private funds. Each month Infrastructure Capital hosts a monthly economic webinar; you can sign up to attend by visiting our website www.infracapfunds.com (important disclosures can also be found on the website). For a prospectus please reach out to us or visit the links above for each respective fund.

DISCLOSURE

This information is not an offer to sell, or solicitation of an offer to buy any investment product, security, or services offered by Jay Hatfield, or Infrastructure Capital Advisors, LLC, (“ICA”) or its affiliates. ICA, will only conduct such solicitation of an offer to buy any investment product or service offered by ICA, if at all, by (1) purported definitive documentation (which will include disclosures relating to investment objective, policies, risk factors, fees, tax implications and relevant qualifications), (2) to qualified participants, if applicable, and (3) only in those jurisdictions where permitted by law. Jay Hatfield or ICA may have a beneficial long or short position in securities discussed either through stock ownership, options, or other derivatives; nonetheless, under no circumstances does any article or interview represent a recommendation to buy or sell these securities. This discussion is intended to provide insight into stocks and the market for entertainment and information purposes only and is not a solicitation of any kind. ICA buys and sells securities on behalf of its fund investors and may do so, before and after any particular article herein is published, with respect to the securities discussed in any article posted. ICA's appraisal of a company (price target) is only one factor that affects its decision whether to buy or sell shares in that company. Other factors might include, but are not limited to, the presence of mandatory limits on individual positions, decisions regarding portfolio exposures, and general market conditions and liquidity needs. As such, there may not always be consistency between the views expressed here and ICA's trading or holdings on behalf of its fund investors. There may be conflicts between the content posted or discussed and the interests of ICA. Please reach out to the ICA for more information. Investors should make their own decisions regarding any investments mentioned, and their prospects based on such investors’ own review of publicly available information and should not rely on the information contained herein. ICA nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. We have not sought, nor have we received, permission from any third-party to include their information in this article. Certain information contained in this document constitutes “forward-looking statements,” which can be identified by the use of forward-looking terminology such as “may,” “will,” “should,” “expect,” “anticipate,” “project,” “estimate,” “intend,” “continue” or “believe” or the negatives thereof or other variations thereon or other comparable terminology. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking statements.

The information contained herein represents our subjective belief and opinions and should not be construed as investment, tax, legal, or financial advice. Investors should consider the investment objectives, risks, charges, and expenses carefully before investing. Please read the prospectus carefully before investing. For more information about the Fund, Fund strategies or Infrastructure Capital, please reach out to Craig Starr at 212-763-8336 (Craig.Starr@icmllc.com). The Funds are distributed either by Quasar Distributors, LLC or by VP Distributors, LLC, an affiliate of Virtus ETF Advisers, LLC. ICAP, SCAP, and BNDS ETFs are distributed by Quasar Distributors LLC. PFFA, PFFR, and AMZA ETFs are distributed by VP Distributors, LLC an affiliated of Virtus ETF Advisers, LLC.