Beyond the well-documented size premium, which refers to the historical tendency for small-cap stocks to outperform large caps over long periods (as outlined by Fama and French), small caps may also offer a key advantage for income-focused investors.

This advantage isn’t limited to dividends. When liquidity conditions are healthy and a robust options market exists, buy-write or covered call strategies on small-cap names can often command higher option premiums.

All else being equal, a small-cap covered call strategy can potentially generate more income than a large-cap equivalent, thanks to the underlying mechanics of options pricing.

Here's an instructive example using index options on both the S&P 500 Index (SPX) and the Russell 2000 Index (RUT).

Quantifying the yield pick-up

One of the less talked-about advantages of small-cap indexes is their potential to generate higher income through covered call strategies.

To see this in action, let’s compare at-the-money (ATM) or slightly out-of-the-money (OTM) call options on the RUT and the SPX, both expiring July 11, 2025.

At the time of observation (June 25th, 2025):

Russell 2000 Index (RUT): 2,144.19

S&P 500 Index (SPX): 6,091.85

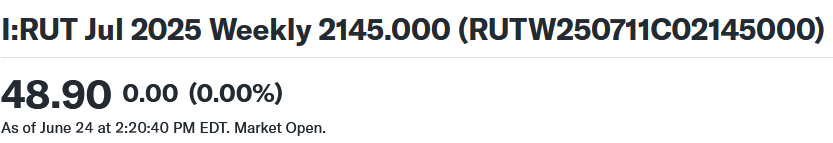

RUT 2145 call option: $48.90

SPX 6090 call option: $76.40

These contracts are effectively a similar distance from the current index level and have identical expiry dates, so we can isolate and evaluate one thing: the yield differential.

To compare income potential, we calculate the yield from the premium collected as a percentage of the index level:

RUT yield = $48.90 / 2,144.19 = ~2.28%

SPX yield = $76.40 / 6,091.85 = ~1.25%

This means writing a two-week covered call on the Russell 2000 currently offers almost double the income compared to the same trade on the S&P 500. The difference comes down to one core factor: implied volatility.

When option expiration and moneyness are roughly equivalent, implied volatility becomes the dominant input into option pricing. And the Russell 2000, as a small-cap index, tends to exhibit significantly higher volatility than its large-cap counterpart. Putting it together:

Higher volatility = Greater probability the option finishes in the money.

Greater probability = Higher premium buyers have to pay to compensate for the risk.

Higher premium = Higher yield for the seller of the call.

The higher premium compensates sellers for the added risk that the more volatile index rises above the strike and the call is exercised.

In practice, this dynamic means small-cap indexes like RUT may consistently offer a higher covered call yield potential, assuming there are no temporary distortions in pricing for certain contracts.

How to put it in practice

One important caveat with using Russell 2000 index options, or options on a Russell 2000 ETF for a covered call strategy is the nature of the underlying itself.

In a buy-write strategy, you're implicitly long the asset. So before anything else, you need to ask: Is this something I actually want to own?

That question matters because a non-trivial portion of the Russell 2000 consists of unprofitable companies, many of which have negative earnings or operate with persistently low margins.

Using cash-settled index options avoids direct ownership, but selling covered calls on a Russell 2000 ETF exposes you to a potentially lower-quality portfolio. In our view, that's not optimal for income-first investors.

Instead, we prefer a more selective approach: screening for small-cap stocks that are profitable, pay consistent and meaningful dividends, and trade at valuations that make sense based on earnings growth and cash flows.

The idea is to start with a fundamentally sound equity base that’s attractive to own over the long term, even without the options overlay.

Once a solid foundation for small-cap ownership is established, investors can still benefit from the higher volatility of the segment as a whole by selling cash-settled Russell 2000 index options.

It’s a way to capture elevated premiums while maintaining a quality-focused portfolio, potentially offering the best of both worlds.

About Us

Jay D. Hatfield is CEO of Infrastructure Capital Advisors and is the lead portfolio manager of the Infrastructure Capital Bond Income ETF (NYSE: BNDS), InfraCap Small Cap Income ETF (NYSE: SCAP), InfraCap Equity Income Fund ETF (NYSE: ICAP), InfraCap MLP ETF (NYSE: AMZA), Virtus InfraCap U.S. Preferred Stock ETF (NYSE: PFFA), InfraCap REIT Preferred ETF (NYSE: PFFR) and private funds. Each month Infrastructure Capital hosts a monthly economic webinar; you can sign up to attend by visiting our website www.infracapfunds.com (important disclosures can also be found on the website). For a prospectus please reach out to us or visit the links above for each respective fund.

DISCLOSURE

This information is not an offer to sell, or solicitation of an offer to buy any investment product, security, or services offered by Jay Hatfield, or Infrastructure Capital Advisors, LLC, (“ICA”) or its affiliates. ICA, will only conduct such solicitation of an offer to buy any investment product or service offered by ICA, if at all, by (1) purported definitive documentation (which will include disclosures relating to investment objective, policies, risk factors, fees, tax implications and relevant qualifications), (2) to qualified participants, if applicable, and (3) only in those jurisdictions where permitted by law. Jay Hatfield or ICA may have a beneficial long or short position in securities discussed either through stock ownership, options, or other derivatives; nonetheless, under no circumstances does any article or interview represent a recommendation to buy or sell these securities. This discussion is intended to provide insight into stocks and the market for entertainment and information purposes only and is not a solicitation of any kind. ICA buys and sells securities on behalf of its fund investors and may do so, before and after any particular article herein is published, with respect to the securities discussed in any article posted. ICA's appraisal of a company (price target) is only one factor that affects its decision whether to buy or sell shares in that company. Other factors might include, but are not limited to, the presence of mandatory limits on individual positions, decisions regarding portfolio exposures, and general market conditions and liquidity needs. As such, there may not always be consistency between the views expressed here and ICA's trading or holdings on behalf of its fund investors. There may be conflicts between the content posted or discussed and the interests of ICA. Please reach out to the ICA for more information. Investors should make their own decisions regarding any investments mentioned, and their prospects based on such investors’ own review of publicly available information and should not rely on the information contained herein. ICA nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. We have not sought, nor have we received, permission from any third-party to include their information in this article. Certain information contained in this document constitutes “forward-looking statements,” which can be identified by the use of forward-looking terminology such as “may,” “will,” “should,” “expect,” “anticipate,” “project,” “estimate,” “intend,” “continue” or “believe” or the negatives thereof or other variations thereon or other comparable terminology. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking statements.

The information contained herein represents our subjective belief and opinions and should not be construed as investment, tax, legal, or financial advice. Investors should consider the investment objectives, risks, charges, and expenses carefully before investing. Please read the prospectus carefully before investing. For more information about the Fund, Fund strategies or Infrastructure Capital, please reach out to Craig Starr at 212-763-8336 (Craig.Starr@icmllc.com). The Funds are distributed either by Quasar Distributors, LLC or by VP Distributors, LLC, an affiliate of Virtus ETF Advisers, LLC. ICAP, SCAP, and BNDS ETFs are distributed by Quasar Distributors LLC. PFFA, PFFR, and AMZA ETFs are distributed by VP Distributors, LLC an affiliated of Virtus ETF Advisers, LLC.