The U.S. economy today has two stories to tell. Both consumer and business sentiment looks gloomy, though the data continue to indicate solid economic growth. Surveys signal mounting anxiety over inflation and job security even as hard gauges — employment, G.D.P., spending — still register resilience. That dissonance has left investors and policy makers wondering whether the pessimism is premature or prescient.

Source: YCharts

Soft Sentiment: The Gloom is in the Air

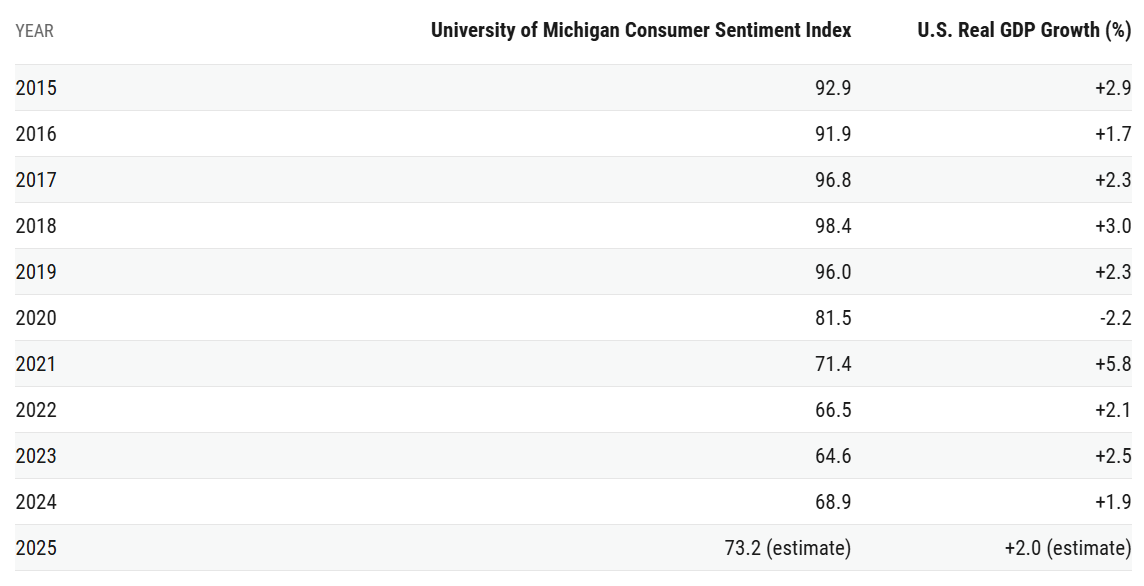

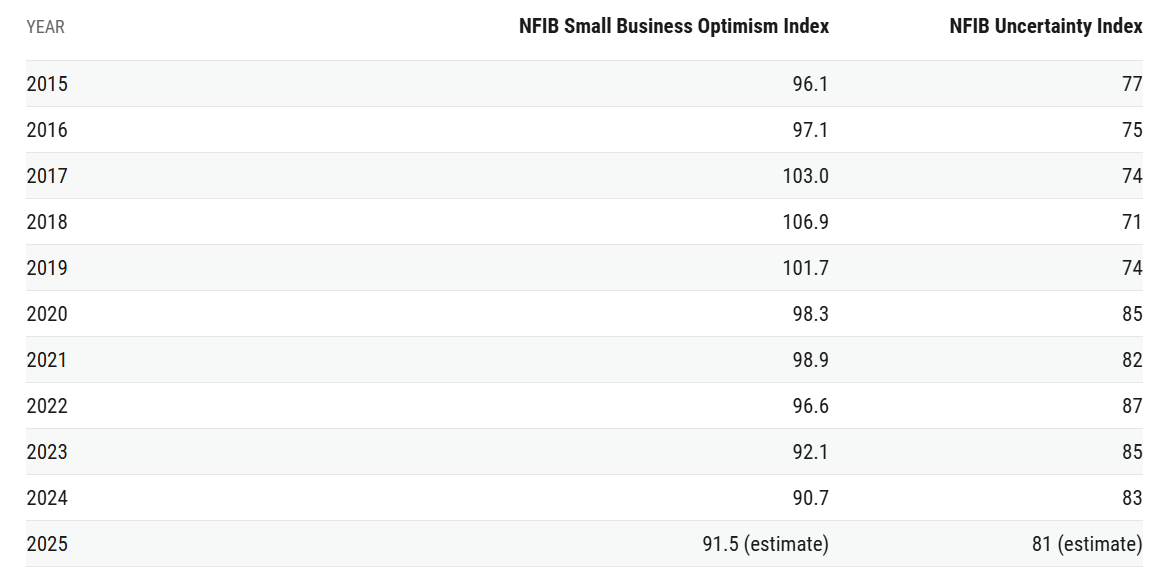

Indeed, the University of Michigan’s Consumer Sentiment Index just posted one of its lowest readings in decades – the kind you’d expect if we were in a recession rather than growing at 4% (or so) last quarter¹². Small business confidence has fallen as well: the National Federation of Independent Business (NFIB) index disappointed in September, with the uncertainty component at its highest in over five decades³⁴.

Chronic inflation, especially of staples such as food and housing, remains the main suspect⁵⁶. While headline inflation has abated, “pocketbook” inflation still dominates household psychology⁷. The frustration is compounded by higher borrowing costs, and the uneven wealth effects—equity holders are doing better than renters and low earners —have exacerbated a mood gap⁶. Confidence indicators, in other words, are still a flashing yellow signal despite steady economic conditions.

Source: YCharts

Robust Data: An Economy That Won’t Take No for an Answer

Nevertheless, economic data continues to be strong. GDP in the second quarter of 2025 was reported to have increased at a 3.8% annualized rate —its fastest pace in almost twenty-four months⁸. Consumer spending remains solid: Retail sales rose 0.6% in August amid a robust back-to-school season¹⁰¹. Unemployment claims are low and layoffs scarce, indicating that companies continue to be hesitant to lay off workers¹². At the same time, capital expenditure—specifically in technology and AI equipment—has also contributed to momentum9¹².

To be fair here, not every metric is rosy. Factory output has weakened, and some of it was the result of temporary trade maneuvers rather than underlying demand¹³. And yet the hard data continues to show steady expansion, despite public sentiment.

The Macro Crossroads

Sooner or later, sentiment and data have to converge. Should such gloom and doom depress spending, growth would slow down, confirming the gloom. Preliminary signs of pullback are emerging in durable goods and hiring patterns¹⁴. Conversely, falling inflation and stable incomes might boost confidence, supporting a recovery¹⁵. Investors need to tread carefully in this two-speed world.

Fear can bring opportunity: when markets prematurely price in a recession that doesn’t happen, disciplined investors can benefit from mispriced assets¹⁶. But ignoring warning signs is just as perilous. The way forward probably involves a balance between caution and conviction — staying awake to actual risks Either way, the economy right now is a paradox — pessimistic in mood, optimistic in data. The next macro surprise depends on who wins, the pessimists or the data.

Footnotes

Consumer sentiment remains unusually weak despite solid economic growth, Plante Moran, September 2025.

Ibid.

NFIB Small Business Survey: Optimism Declines as Uncertainty Rises, Advisor Perspectives, October 2025.

Ibid.

Consumer sentiment remains unusually weak, Plante Moran.

Ibid.

U.S. consumer sentiment steady in October, but labor market worries persist, Reuters, October 2025.

U.S. economy notches fastest growth pace in nearly two years, Reuters, September 2025.

Ibid.

August Retail Sales Reflect Consumer Resilience—for Now, Conference Board, September 2025.

Ibid.

U.S. economy notches fastest growth pace in nearly two years, Reuters.

Ibid.

U.S. consumer sentiment steady in October, Reuters.

Ibid.

Understanding the Gap Between “Hard” and “Soft” Economic Indicators, Sterling Wealth Management, 2025.

About Us

Jay D. Hatfield is CEO of Infrastructure Capital Advisors and is the lead portfolio manager of the Infrastructure Capital Bond Income ETF (NYSE: BNDS), InfraCap Small Cap Income ETF (NYSE: SCAP), InfraCap Equity Income Fund ETF (NYSE: ICAP), InfraCap MLP ETF (NYSE: AMZA), Virtus InfraCap U.S. Preferred Stock ETF (NYSE: PFFA), InfraCap REIT Preferred ETF (NYSE: PFFR) and private funds. Each month Infrastructure Capital hosts a monthly economic webinar; you can sign up to attend by visiting our website www.infracapfunds.com (important disclosures can also be found on the website). For a prospectus please reach out to us or visit the links above for each respective fund.

DISCLOSURE

This information is not an offer to sell, or solicitation of an offer to buy any investment product, security, or services offered by Jay Hatfield, or Infrastructure Capital Advisors, LLC, (“ICA”) or its affiliates. ICA, will only conduct such solicitation of an offer to buy any investment product or service offered by ICA, if at all, by (1) purported definitive documentation (which will include disclosures relating to investment objective, policies, risk factors, fees, tax implications and relevant qualifications), (2) to qualified participants, if applicable, and (3) only in those jurisdictions where permitted by law. Jay Hatfield or ICA may have a beneficial long or short position in securities discussed either through stock ownership, options, or other derivatives; nonetheless, under no circumstances does any article or interview represent a recommendation to buy or sell these securities. This discussion is intended to provide insight into stocks and the market for entertainment and information purposes only and is not a solicitation of any kind. ICA buys and sells securities on behalf of its fund investors and may do so, before and after any particular article herein is published, with respect to the securities discussed in any article posted. ICA’s appraisal of a company (price target) is only one factor that affects its decision whether to buy or sell shares in that company. Other factors might include, but are not limited to, the presence of mandatory limits on individual positions, decisions regarding portfolio exposures, and general market conditions and liquidity needs. As such, there may not always be consistency between the views expressed here and ICA’s trading or holdings on behalf of its fund investors. There may be conflicts between the content posted or discussed and the interests of ICA. Please reach out to the ICA for more information. Investors should make their own decisions regarding any investments mentioned, and their prospects based on such investors’ own review of publicly available information and should not rely on the information contained herein. ICA nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. We have not sought, nor have we received, permission from any third-party to include their information in this article. Certain information contained in this document constitutes “forward-looking statements,” which can be identified by the use of forward-looking terminology such as “may,” “will,” “should,” “expect,” “anticipate,” “project,” “estimate,” “intend,” “continue” or “believe” or the negatives thereof or other variations thereon or other comparable terminology. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking statements.

The information contained herein represents our subjective belief and opinions and should not be construed as investment, tax, legal, or financial advice. Investors should consider the investment objectives, risks, charges, and expenses carefully before investing. Please read the prospectus carefully before investing. For more information about the Fund, Fund strategies or Infrastructure Capital, please reach out to Craig Starr at 212-763-8336 (Craig.Starr@icmllc.com). The Funds are distributed either by Quasar Distributors, LLC or by VP Distributors, LLC, an affiliate of Virtus ETF Advisers, LLC. ICAP, SCAP, and BNDS ETFs are distributed by Quasar Distributors LLC. PFFA, PFFR, and AMZA ETFs are distributed by VP Distributors, LLC an affiliated of Virtus ETF Advisers, LLC.