Plenty has been said about the flaws of passive small-cap ETFs that track the Russell 2000. One of the biggest issues is the index’s sheer breadth and relatively loose inclusion criteria, which allow hundreds of “zombie” companies (businesses with little to no profitability) to remain in the mix.

That in turn contributes to another common knock against the index: volatility. Because of their size and weaker fundamentals, many Russell 2000 constituents can swing wildly, making the index much more volatile than large-cap benchmarks like the S&P 500. For some investors, that’s reason enough to avoid small caps altogether.

We believe the InfraCap Small Cap Income ETF (SCAP) offers a more thoughtful alternative. By combining actively managed, value-conscious stock selection with the ability to tactically allocate to preferred shares and write options, SCAP is designed to potentially dampen volatility while boosting income.

SCAP: Seeking Lower Volatility

SCAP doesn’t attempt to replicate the full investable universe of U.S. small caps. Instead, the strategy narrows the field by focusing on three attributes that historically correlate with stronger fundamentals and lower volatility.

First is profitability. Some small-cap stocks generate little to no earnings, which adds to their volatility and lowers the reliability of future returns. SCAP, in contrast, targets companies with positive earnings and durable margins. These are businesses with demonstrated financial discipline and a clearer path to compounding returns over time.

Second is the presence of a dividend. Dividend payers are relatively rare in the small-cap space, so identifying them often reveals businesses with healthier cash flows, more mature operations, and shareholder-friendly capital allocation. It also adds an income component to the portfolio that can help cushion volatility.

Finally, SCAP emphasizes valuation. Target holdings must trade at reasonable multiples of both growth and earnings. That avoids speculative small caps with sky-high price-to-sales ratios or structurally unprofitable business models that rely on capital markets to survive.

Taken together, this approach filters out the weakest links and concentrates the portfolio in higher-quality small caps: businesses that are generating cash, returning capital, and not simply surviving on promises.

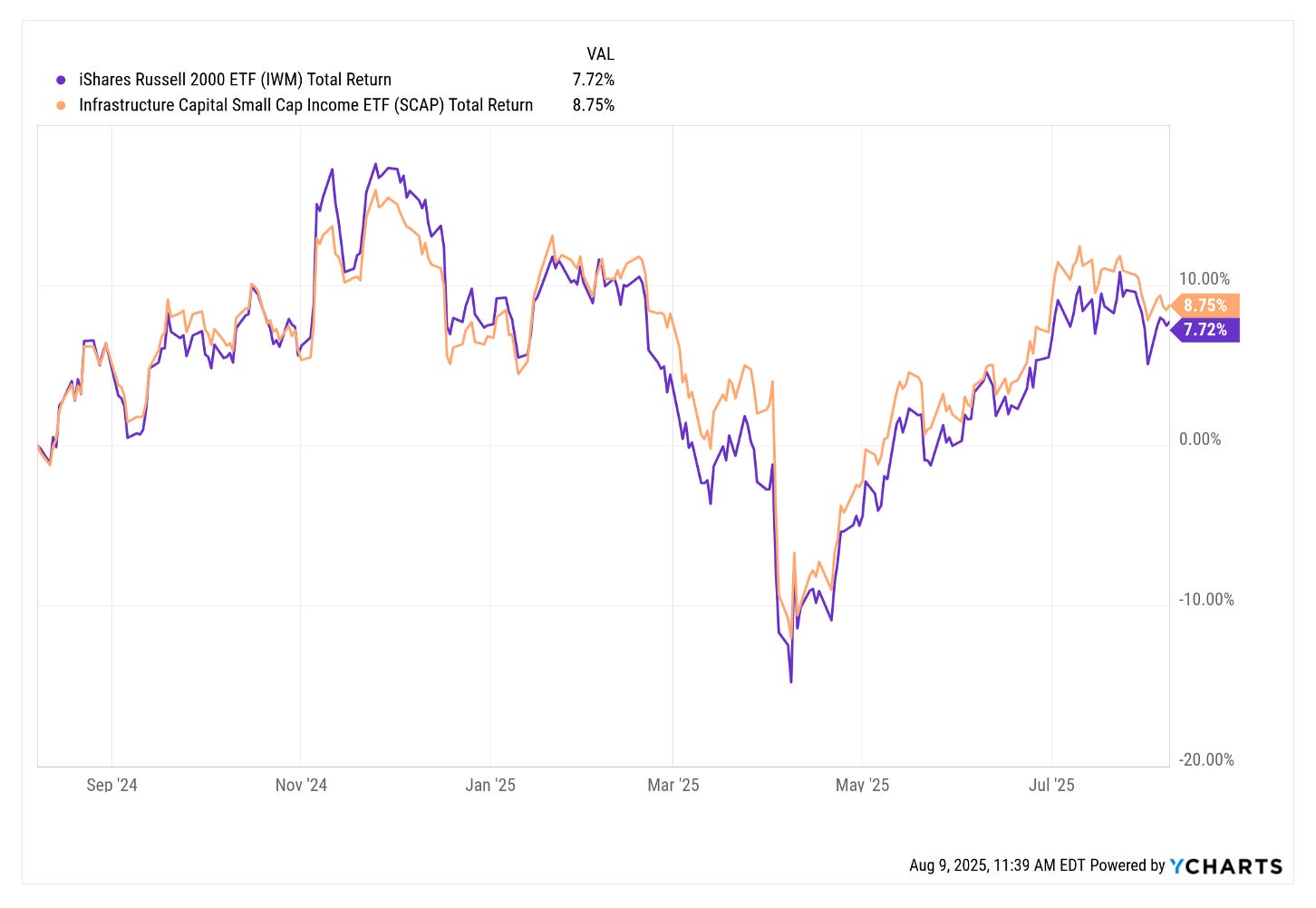

Over the period shown in the chart below, that quality tilt has translated into consistently lower volatility for SCAP compared to ETFs tracking the Russell 2000 index, even during dislocations like April/May 2025's tariff-induced selloff.

SCAP: Seeking Higher Yield

The Russell 2000 Index isn’t known for its income potential. Many of the small-cap stocks it includes are still in the early stages of development, meaning they often lack the free cash flow or stability required to support a regular dividend. As a result, ETFs tracking this benchmark may only offer a yield of around 1%, give or take.

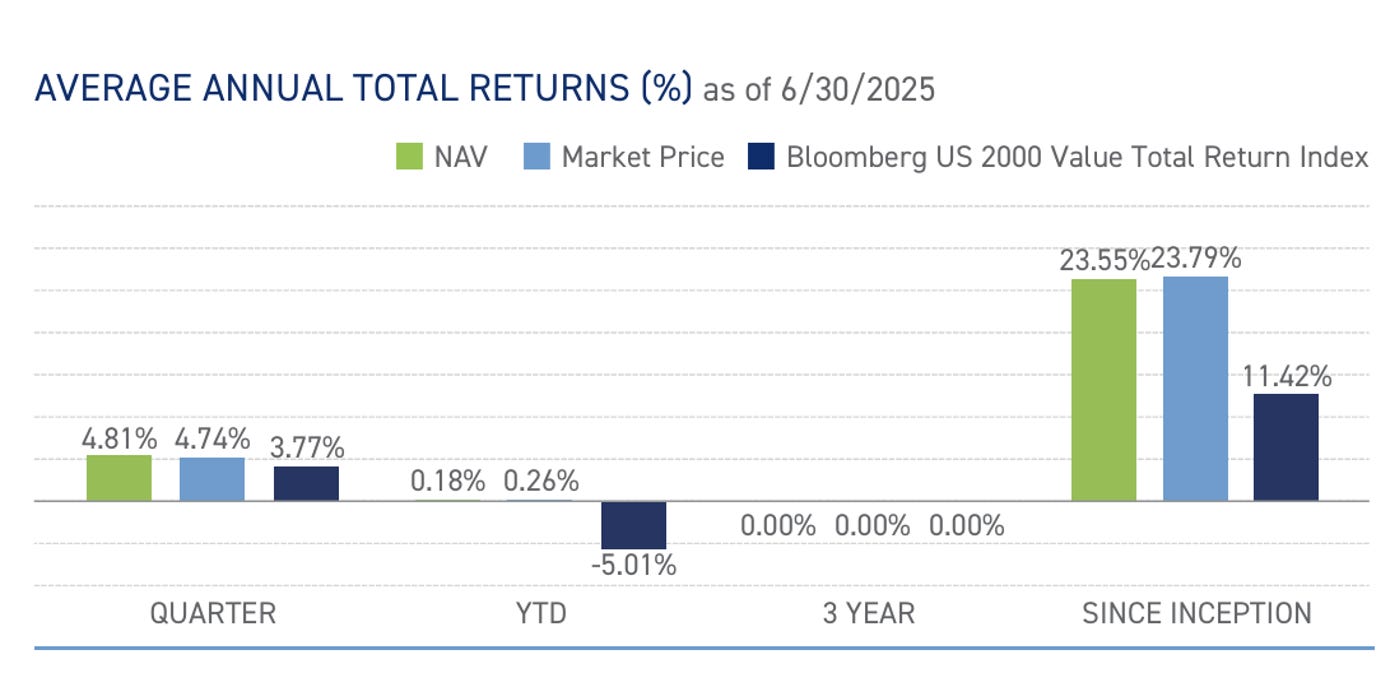

In contrast, SCAP pays a 6.17% 30-day SEC yield, as of 6/30/25. Part of that is due to its dividend-focused screening process, which favors profitable small caps that already return capital to shareholders. But SCAP also structurally enhances its income profile through two additional sources.

The first is options writing. Even though the portfolio itself is actively managed and differs meaningfully from the Russell 2000, SCAP opportunistically writes index options on the Russell 2000 or ETFs to capture volatility premiums. This allows the fund to tap into the higher implied volatility of the benchmark without owning many of the lower-quality names responsible for it.

The second is modest leverage. SCAP can deploy between 10% and 30% notional leverage to amplify exposure to dividend-paying holdings and increase capital allocated to its covered call strategy. This boosts distributable income while maintaining exposure to higher-quality businesses.

While yield isn’t the whole story, SCAP’s advantage isn’t limited to income alone. As shown in the chart below, it also led the Russell 2000 ETF (IWM) on a total return basis over the past year, with distributions reinvested, as of 8/8/25.

Performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Please call 800-617-0004 for performance data current to the most recent month end. SCAP’s inception date is December 11, 2023.

The Russell 2000 Index is a small-cap U.S. stock market index that makes up the smallest 2,000 stocks in the Russell Index. It was started by the Frank Russell Company in 1984. The index is maintained by FTSE Russell, a subsidiary of the London Stock Exchange Group.

Free Cash Flow (FCF) is a financial metric representing the cash a company generates from its operations after accounting for necessary business expenditures, such as operating expenses and investments in assets (capital expenditures).

About Us

Jay D. Hatfield is CEO of Infrastructure Capital Advisors and is the lead portfolio manager of the Infrastructure Capital Bond Income ETF (NYSE: BNDS), InfraCap Small Cap Income ETF (NYSE: SCAP), InfraCap Equity Income Fund ETF (NYSE: ICAP), InfraCap MLP ETF (NYSE: AMZA), Virtus InfraCap U.S. Preferred Stock ETF (NYSE: PFFA), InfraCap REIT Preferred ETF (NYSE: PFFR) and private funds. Each month Infrastructure Capital hosts

a monthly economic webinar; you can sign up to attend by visiting our website www.infracapfunds.com (important disclosures can also be found on the website). For a prospectus please reach out to us or visit the links above for each respective fund.

DISCLOSURE

This information is not an offer to sell, or solicitation of an offer to buy any investment product, security, or services offered by Jay Hatfield, or Infrastructure Capital Advisors, LLC, (“ICA”) or its affiliates. ICA, will only conduct such solicitation of an offer to buy any investment product or service offered by ICA, if at all, by (1) purported definitive documentation (which will include disclosures relating to investment objective, policies, risk factors, fees, tax implications and relevant qualifications), (2) to qualified participants, if applicable, and (3) only in those jurisdictions where permitted by law. Jay Hatfield or ICA may have a beneficial long or short position in securities discussed either through stock ownership, options, or other derivatives; nonetheless, under no circumstances does any article or interview represent a recommendation to buy or sell these securities. This discussion is intended to provide insight into stocks and the market for entertainment and information purposes only and is not a solicitation of any kind. ICA buys and sells securities on behalf of its fund investors and may do so, before and after any particular article herein is published, with respect to the securities discussed in any article posted. ICA's appraisal of a company (price target) is only one factor that affects its decision whether to buy or sell shares in that company. Other factors might include, but are not limited to, the presence of mandatory limits on individual positions, decisions regarding portfolio exposures, and general market conditions and liquidity needs. As such, there may not always be consistency between the views expressed here and ICA's trading or holdings on behalf of its fund investors. There may be conflicts between the content posted or discussed and the interests of ICA. Please reach out to the ICA for more information.

Investors should make their own decisions regarding any investments mentioned, and their prospects based on such investors’ own review of publicly available information and should not rely on the information contained herein.

ICA nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. We have not sought, nor have we received, permission from any third-party to include their information in this article.

Certain information contained in this document constitutes “forward-looking statements,” which can be identified by the use of forward-looking terminology such as “may,” “will,” “should,” “expect,” “anticipate,” “project,” “estimate,” “intend,” “continue” or “believe” or the negatives thereof or other variations thereon or other comparable terminology. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking statements.

The information contained herein represents our subjective belief and opinions and should not be construed as investment, tax, legal, or financial advice. Investors should consider the investment objectives, risks, charges, and expenses carefully before investing. Please read the prospectus carefully before investing. For more information about the Fund, Fund strategies or Infrastructure Capital, please reach out to Craig Starr at 212- 763-8336 (Craig.Starr@icmllc.com). The Funds are distributed either by Quasar Distributors, LLC or by VP Distributors, LLC, an affiliate of Virtus ETF Advisers, LLC. ICAP, SCAP, and BNDS ETFs are distributed by Quasar Distributors LLC. PFFA, PFFR, and AMZA ETFs are distributed by VP Distributors, LLC an affiliated of Virtus ETF Advisers, LLC.

Fund Risks

This material must be preceded or accompanied by a prospectus. Investors should consider the investment objectives, risks, charges, and expenses carefully before investing. Please read the prospectus carefully before investing. For more information about the Fund, Fund strategies or Infrastructure Capital, please reach out to Craig Starr at 212-763-8336 (Craig.Starr@icmllc.com).

A word about SCAP risk: Investing involves risk, including possible loss of principal. An investment in the Fund may be subject to risks which include, among others, investing in equities securities, dividend paying securities, utilities, small-, mid- and large-capitalization companies, real estate investment trusts, master limited partnerships, foreign investments and emerging, debt securities, depositary receipts, market events, operational, high portfolio turnover, trading issues, active management, fund shares trading, premium/discount risk and liquidity of fund shares, which may make these investments volatile in price. Foreign investments are subject to risks, which include changes in economic and political conditions, foreign currency fluctuations, changes in foreign regulations, and changes in currency exchange rates which may negatively impact the Fund’s returns. Small and Medium- capitalization companies, foreign investments and high yielding equity and debt securities may be subject to elevated risks. The Fund is a recently organized investment company with no operating history. Please see prospectus for discussion of risks. Diversification cannot assure a profit or protect against loss in a down market. SCAP is distributed by Quasar Distributors, LLC.

A word about ICAP Risk: Investing involves risk, including possible loss of principal. An investment in the Fund may be subject to risks which include, among others, investing in equities securities, dividend paying securities, utilities, preferred stocks, leverage, short sales, small-, mid- and large- capitalization companies, real estate investment trusts, master limited partnerships, foreign investments and emerging, debt securities, depositary receipts, market events, operational, high portfolio turnover, trading issues, options, active management, fund shares trading, premium/discount risk and liquidity of fund shares, which may make these investments volatile in price. Foreign investments are subject to risks, which include changes in economic and political conditions, foreign currency fluctuations, changes in foreign regulations, and changes in currency exchange rates which may negatively impact the Fund's returns. Small and Medium-capitalization companies, foreign investments, options, leverage, short sales, and high yielding equity and debt securities may be subject to elevated risks. The Fund is a recently organized investment company with no operating history. Please see prospectus for discussion of risks. ICAP fund distributor, Quasar Distributors, LLC.

A word about BNDS risk: Investing involves risk, including possible loss of principal. An investment in the Fund may be subject to risks which include, among others, investing in fixed income securities, dividend paying securities, utilities, small-, mid- and large-capitalization companies, real estate investment trusts, master limited partnerships, debt securities, market events, operational, high portfolio turnover, trading issues, active management, fund shares trading, premium/discount risk and liquidity of fund shares, which may make these investments volatile in price. Small and Medium-capitalization companies, and high yielding equity and debt securities may be subject to elevated risks. New Fund Risk. The Fund is a recently organized investment company with no operating history prior to the date of this Prospectus. As a result, prospective investors have no track record or history on which to base their investment decision. Debt Securities Risk. Increases in interest rates typically lower the value of debt securities held by the Fund. Investments in debt securities include credit risk. Credit Risk. An issuer of debt securities may not make timely payments of principal and interest and may default entirely in its obligations. A decrease in the issuer’s credit rating may lower the value of debt securities.

Interest Rate Risk. Securities could lose value because of interest rate changes. For example, bonds tend to decrease in value if interest rates rise. Derivatives Risk. Derivatives may pose risks in addition to and greater than those associated with investing directly in securities, currencies or other investments, including risks relating to leverage, imperfect correlations with underlying investments or the Fund’s other portfolio holdings, high price volatility, lack of availability, counterparty credit, liquidity, valuation and legal restrictions.

Options Risk. Options transactions involve special risks that may make it difficult or impossible to close a position when the Fund desires. A fund that purchases options, which are a type of derivative, is subject to the risk that gains, if any, realized on the position, will be less than the amount paid as premiums to the writer of the option. BNDS fund distributor, Quasar Distributors, LLC.

The Funds are distributed either by Quasar Distributors, LLC or by VP Distributors, LLC, an affiliate of Virtus ETF Advisers, LLC. ICAP, SCAP, and BNDS ETFs are distributed by Quasar Distributors LLC. PFFA, PFFR, and AMZA ETFs are distributed by VP Distributors, LLC an affiliated of Virtus ETF Advisers, LLC.