There’s no shortage of REIT ETFs. Some take a broad-based approach, tracking indexes that weight nearly the entire investable U.S.-listed REIT universe by market cap. Others go global. Some zero in on specific subsectors like residential or industrial REITs. A few try to ride the AI wave by focusing on data centers.

The InfraCap REIT Preferred ETF (PFFR) doesn’t use any of these. Uniquely, it is the only U.S.-listed ETF currently offering exposure to REITs not via their common equity but via preferred stocks. PFFR offers investors a potentially more defensive and higher-yielding way to access real estate-linked cash flows.

It’s potentially a unique angle on real estate income, and one worth understanding for investors looking for a differentiated allocation to their portfolio. Here's what you need to know.

The Strategy Behind PFFR

We launched PFFR by leveraging our expertise in preferred equity, built through the success of the Virtus InfraCap U.S. Preferred Stock ETF (PFFA), and applying it to real assets.

It started with a simple understanding: investors turn to REITs for diversification. Their growth and returns are often driven by real estate fundamentals: occupancy rates, rental escalations, and sector-specific demand trends, rather than traditional equity market movements.

But we also heard the common frustration. Because REITs trade like stocks, they often come with a higher beta and more volatility than you’d expect from real estate-linked cash flows.

We wanted to solve that by keeping what makes real estate attractive: the steady cash flow tied to physical properties, but with reduced market sensitivity.

So, we focused on REIT preferreds. These securities typically offer the same income potential with lower volatility. They’re also generally issued with less leverage and backed by more predictable revenue streams than preferreds from financial institutions like banks and insurers.

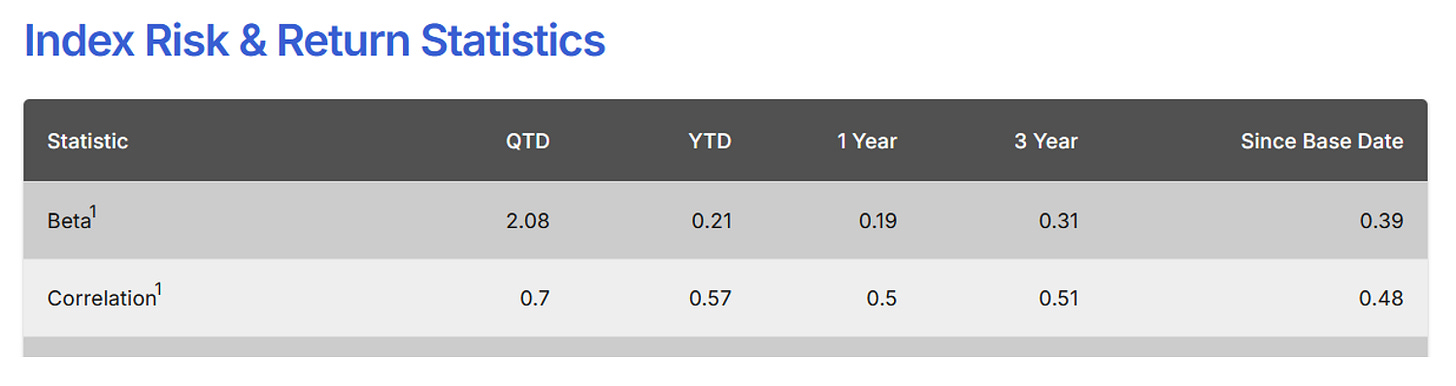

By leveraging the Indxx REIT Preferred Stock Index, PFFR's strategy could provide a lower beta and correlation to traditional asset classes.

The ETF wrapper made sense. It offers liquidity and tax efficiency, and with continued growth in preferred indexing, we now have the tools to carve out sector-specific exposure while maintaining ample liquidity for end investors.

That’s how PFFR came to be. It’s a focused, real estate sector-specific preferred ETF we believe fills a critical gap.

How PFFR Works

As of March 31, 2025, PFFR's portfolio showed a thoughtfully diversified mix across sectors and credit tiers, designed to optimize yield while mitigating risk.

At this time, roughly three-quarters of the portfolio was allocated to property REITs, with the remaining 25.88% in mortgage REITs.

Within the property REIT sleeve, holdings were spread across diversified operators (17.66%), data centers (12.72%), office REITs (12.04%), and niche segments like storage, hotels, and healthcare. This breadth helps insulate the fund from any single subsector downturn.

On the credit side, PFFR’s holdings were heavily skewed toward unrated preferreds which is typical in the preferred space and not necessarily a red flag. Many REIT preferreds are not formally rated but still offer consistent distributions and strong underlying cash flows.

That said, there was still a meaningful allocation to investment grade and near-investment-grade names, including 8.45% in A-rated securities and another ~12% across the BBB and BBB- tiers (as of March 31, 2025 fact sheet)*.

The top five holdings included preferred shares from well-known names like DigitalBridge, UMH Properties, Digital Realty, and Hudson Pacific (as of March 31, 2025 fact sheet). These are generally established operators with deep asset portfolios, and many operate in secular growth verticals like data centers and communications infrastructure.

PFFR is priced competitively at a 0.45% expense.

Please consider the investment objectives, risks, charges and expenses of the Fund carefully before investing. The prospectus contains this and other information about the Fund. Contact us at 1-888-383-0553 or visit www.virtus.com for a copy of the Fund's prospectus. Read the prospectus carefully before you invest or send money.

RATINGS DISTRIBUTION METHODOLOGY

*Credit quality ratings on underlying securities of the Fund are received from S&P, Moody’s, and Fitch and converted to the equivalent S&P major rating category. This breakdown is provided by Infrastructure Capital Advisors and takes the median rating of the three agencies when all three agencies rate a security, the lower of the two ratings if only two agencies rate a security, and one rating if that is all that is provided. Unrated securities do not necessarily indicate low quality. Below investment-grade is represented by a rating of BB and below. Ratings and portfolio credit quality may change over time.

Exchange-Traded Funds (ETF): The value of an ETF may be more volatile than the underlying portfolio of securities it is designed to track. The costs to the portfolio of owning shares of an ETF may exceed the cost of investing directly in the underlying securities. Equity REITs: The portfolio may be negatively affected by factors specific to the real estate market, such as interest rates, leverage, property, and management; and factors specific to investing in a pooled vehicle such as poor management and concentration risk. Preferred Stocks: Preferred stocks may decline in price, fail to pay dividends, or be illiquid. Industry/Sector Concentration: A portfolio that focuses its investments in a particular industry or sector will be more sensitive to conditions that affect that industry or sector than a non-concentrated portfolio. Passive Strategy/Index Risk: A passive investment strategy seeking to track the performance of the underlying Index may result in the portfolio holding securities regardless of market conditions or their current or projected performance. This could cause the portfolio’s returns to be lower than if the portfolio employed an active strategy. Correlation to Index: The performance of the portfolio and its index may vary due to factors such as flows, transaction costs, whether the portfolio obtains every security in the index, and timing differences associated with additions to and deletions from the index. REIT Interest Rate: When interest rates rise, the value of REIT securities (including preferred securities) can be expected to decline. The current historically low interest rate environment increases the risk associated with rising interest rates. Small Companies: The market price of equity securities may be affected by financial market, industry, or issuer-specific events. Focus on a particular style or on small or medium-sized companies may enhance that risk. Market Price/NAV: At the time of purchase and/or sale, an investor’s shares may have a market price that is above or below the fund’s NAV, which may increase the investor’s risk of loss. Non-Diversified: The portfolio is not diversified and may be more susceptible to factors negatively impacting its holdings to the extent the portfolio invests more of its assets in the securities of fewer issuers than would a diversified portfolio. Market Volatility: The value of the securities in the portfolio may go up or down in response to the prospects of individual companies and/or general economic conditions. Local, regional, or global events such as war or military conflict, terrorism, pandemic, or recession could impact the portfolio, including hampering the ability of the portfolio’s manager(s) to invest its assets as intended. Prospectus: For additional information on risks, please see the fund’s prospectus. Prospectus: For additional information on risks, please see the fund’s prospectus. PFFA, PFFR, and AMZA are distributed by VP Distributors, LLC, member FINRA and subsidiary of Virtus Investment Partners, Inc.

DISCLOSURE

This information is not an offer to sell, or solicitation of an offer to buy any investment product, security, or services offered by Jay Hatfield, or Infrastructure Capital Advisors, LLC, (“ICA”) or its affiliates. ICA, will only conduct such solicitation of an offer to buy any investment product or service offered by ICA, if at all, by (1) purported definitive documentation (which will include disclosures relating to investment objective, policies, risk factors, fees, tax implications and relevant qualifications), (2) to qualified participants, if applicable, and (3) only in those jurisdictions where permitted by law. Jay Hatfield or ICA may have a beneficial long or short position in securities discussed either through stock ownership, options, or other derivatives; nonetheless, under no circumstances does any article or interview represent a recommendation to buy or sell these securities. This discussion is intended to provide insight into stocks and the market for entertainment and information purposes only and is not a solicitation of any kind. ICA buys and sells securities on behalf of its fund investors and may do so, before and after any particular article herein is published, with respect to the securities discussed in any article posted. ICA's appraisal of a company (price target) is only one factor that affects its decision whether to buy or sell shares in that company. Other factors might include, but are not limited to, the presence of mandatory limits on individual positions, decisions regarding portfolio exposures, and general market conditions and liquidity needs. As such, there may not always be consistency between the views expressed here and ICA's trading or holdings on behalf of its fund investors. There may be conflicts between the content posted or discussed and the interests of ICA. Please reach out to the ICA for more information. Investors should make their own decisions regarding any investments mentioned, and their prospects based on such investors’ own review of publicly available information and should not rely on the information contained herein. ICA nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. We have not sought, nor have we received, permission from any third-party to include their information in this article. Certain information contained in this document constitutes “forward-looking statements,” which can be identified by the use of forward-looking terminology such as “may,” “will,” “should,” “expect,” “anticipate,” “project,” “estimate,” “intend,” “continue” or “believe” or the negatives thereof or other variations thereon or other comparable terminology. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking statements.

The information contained herein represents our subjective belief and opinions and should not be construed as investment, tax, legal, or financial advice. Investors should consider the investment objectives, risks, charges, and expenses carefully before investing. Please read the prospectus carefully before investing. For more information about the Fund, Fund strategies or Infrastructure Capital, please reach out to Craig Starr at 212-763-8336 (Craig.Starr@icmllc.com). The Funds are distributed either by Quasar Distributors, LLC or by VP Distributors, LLC, an affiliate of Virtus ETF Advisers, LLC. ICAP, SCAP, and BNDS ETFs are distributed by Quasar Distributors LLC. PFFA, PFFR, and AMZA ETFs are distributed by VP Distributors, LLC an affiliated of Virtus ETF Advisers, LLC.