Preferred stock ETFs are often passively managed. But the preferred securities market presents a unique mix of structural quirks that can quickly expose the shortcomings of index-based investing. Negative yield-to-call provisions, callable structures, and sector imbalances could use an active hand. Most preferred stock indexes, including the S&P U.S. Preferred Stock Index, are also weighted by size and liquidity; they’re not weighted based on risk, or valuation, or call protection. That can be a problem when the index becomes overconcentrated in financials, or loads up on callable securities trading well above par.¹

Enter the Virtus InfraCap U.S. Preferred Stock ETF (PFFA), which takes a completely different approach. PFFA actively steers into the very inefficiencies that many passive ETFs overlook. Instead of buying the entire market, PFFA screens out negative yield-to-call positions, tactically adjusts its fixed-versus-floating rate-exposure, and diversifies beyond financials.²

One of the primary tools at its disposal is moderate leverage. PFFA generally employs between 20% and 30% leverage to enhance its ability to generate income, and deploys active income strategies across a diversified basket of high-yielding preferred stocks.³

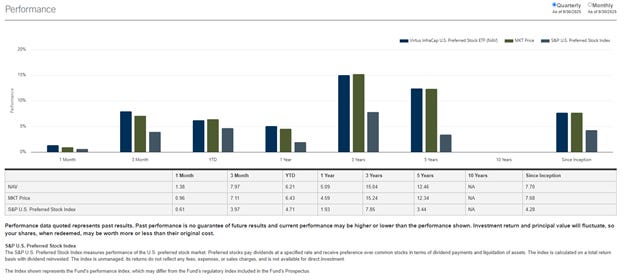

As of September 30, 2025, PFFA reported a 30-day SEC yield of 9.31%, which compares favorably to passive peers. PFFA has also provided long-term outperformance over the S&P U.S Preferred Stock Index, as shown below.

Tax efficiency is yet another potential advantage of the Virtus Infracap U.S. Preferred Stock ETF. The majority of its income is qualified divided income (QDI), which is taxed at a lower rate than interest income from bonds. For higher income tax-bracket investors, this can provide a very powerful after-tax yield edge.7

Structure is important. And PFFA’s structure—active selection, option exposure potential, leverage, and tax-aware distributions—makes it far more than “just another preferred ETF.” For income-focused investors willing to embrace a hands-on strategy in a complex corner of the market, PFFA offers a differentiated value proposition.

Footnotes

Infrastructure Capital Advisors, PFFA: The Case for Active Management With Preferred Stock, August 13, 2025, 3.

Ibid., 4.

Infrastructure Capital Advisors, PFFA: Not All Preferred ETFs Are Built Alike, July 2, 2025, 3.

BlackRock, “iShares Preferred and Income Securities ETF (PFF),” accessed October 15, 2025, https://www.ishares.com.

Infrastructure Capital Advisors, PFFA: The Case for Active Management, 2.

Infrastructure Capital Advisors, PFFA: Not All Preferred ETFs Are Built Alike, 5.

Ibid., 4.

Please consider the investment objectives, risks, charges and expenses of the Fund carefully before investing. The prospectus contains this and other information about the Fund. Contact us at 1-888-383-0553 or visit www.virtus.com for a copy of the Fund’s prospectus. Read the prospectus carefully before you invest or send money.

Inception Date: Standard performance is displayed from Virtus InfraCap US Preferred Stock ETF’s inception date of October 15, 2018.

Exchange-Traded Funds (ETF): The value of an ETF may be more volatile than the underlying portfolio of securities it is designed to track. The costs to the portfolio of owning shares of an ETF may exceed the cost of investing directly in the underlying securities. Preferred Stocks: Preferred stocks may decline in price, fail to pay dividends, or be illiquid. Leverage: When the Fund leverages its portfolio, the Fund may be less liquid and/or may liquidate positions at an unfavorable time, and the value of the Fund’s shares will be more volatile and sensitive to market movements. Non-Diversified: The portfolio is not diversified and may be more susceptible to factors negatively impacting its holdings to the extent the portfolio invests more of its assets in the securities of fewer issuers than would a diversified portfolio. Market Price/NAV: At the time of purchase and/or sale, an investor’s shares may have a market price that is above or below the fund’s NAV, which may increase the investor’s risk of loss. Market Volatility: The value of the securities in the portfolio may go up or down in response to the prospects of individual companies and/or general economic conditions. Local, regional, or global events such as war or military conflict, terrorism, pandemic, or recession could impact the portfolio, including hampering the ability of the portfolio’s manager(s) to invest its assets as intended. Prospectus: For additional information on risks, please see the fund’s prospectus. PFFA is distributed by VP Distributors, LLC, member FINRA and subsidiary of Virtus Investment Partners, Inc.

DISCLOSURE

This information is not an offer to sell, or solicitation of an offer to buy any investment product, security, or services offered by Jay Hatfield, or Infrastructure Capital Advisors, LLC, (“ICA”) or its affiliates. ICA, will only conduct such solicitation of an offer to buy any investment product or service offered by ICA, if at all, by (1) purported definitive documentation (which will include disclosures relating to investment objective, policies, risk factors, fees, tax implications and relevant qualifications), (2) to qualified participants, if applicable, and (3) only in those jurisdictions where permitted by law. Jay Hatfield or ICA may have a beneficial long or short position in securities discussed either through stock ownership, options, or other derivatives; nonetheless, under no circumstances does any article or interview represent a recommendation to buy or sell these securities. This discussion is intended to provide insight into stocks and the market for entertainment and information purposes only and is not a solicitation of any kind. ICA buys and sells securities on behalf of its fund investors and may do so, before and after any particular article herein is published, with respect to the securities discussed in any article posted. ICA’s appraisal of a company (price target) is only one factor that affects its decision whether to buy or sell shares in that company. Other factors might include, but are not limited to, the presence of mandatory limits on individual positions, decisions regarding portfolio exposures, and general market conditions and liquidity needs. As such, there may not always be consistency between the views expressed here and ICA’s trading or holdings on behalf of its fund investors. There may be conflicts between the content posted or discussed and the interests of ICA. Please reach out to the ICA for more information. Investors should make their own decisions regarding any investments mentioned, and their prospects based on such investors’ own review of publicly available information and should not rely on the information contained herein. ICA nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. We have not sought, nor have we received, permission from any third-party to include their information in this article. Certain information contained in this document constitutes “forward-looking statements,” which can be identified by the use of forward-looking terminology such as “may,” “will,” “should,” “expect,” “anticipate,” “project,” “estimate,” “intend,” “continue” or “believe” or the negatives thereof or other variations thereon or other comparable terminology. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking statements.

The information contained herein represents our subjective belief and opinions and should not be construed as investment, tax, legal, or financial advice. Investors should consider the investment objectives, risks, charges, and expenses carefully before investing. Please read the prospectus carefully before investing. For more information about the Fund, Fund strategies or Infrastructure Capital, please reach out to Craig Starr at 212-763-8336 (Craig.Starr@icmllc.com). The Funds are distributed either by Quasar Distributors, LLC or by VP Distributors, LLC, an affiliate of Virtus ETF Advisers, LLC. ICAP, SCAP, and BNDS ETFs are distributed by Quasar Distributors LLC. PFFA, PFFR, and AMZA ETFs are distributed by VP Distributors, LLC an affiliated of Virtus ETF Advisers, LLC.