Rising interest rates, volatile oil prices, and fears of slower growth have weighed on many energy companies. Yet midstream master limited partnerships (MLPs) – the firms that run America’s pipelines and storage terminals – are still generating reliable free cash flow. Their resilience comes from a business model that looks more like a toll road than a wildcat drilling venture, and that makes them stand out even when other parts of the energy patch wobble.

Defensive by Design

Unlike producers that live and die by commodity swings, midstream operators earn fees for moving and storing oil, gas, and natural gas liquids. Contracts are often long term, with take-or-pay clauses and inflation adjustments, which helps stabilize revenue. Demand for these services rarely vanishes: roughly 70 million U.S. households depend on natural gas for basic needs, a baseline that keeps volumes flowing in any economy. That’s why midstream companies often provide consistent earnings guidance when other energy players hesitate.

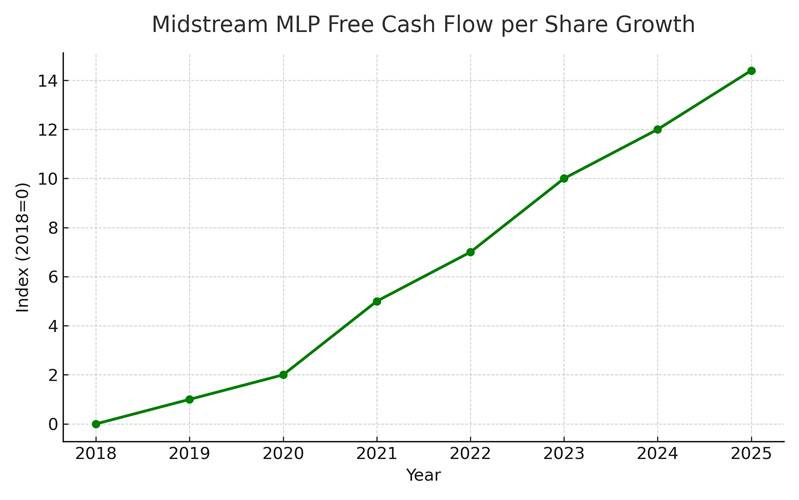

Free cash flow per share for midstream MLPs has risen steadily since 2018, reflecting discipline and contract-driven revenues (GlobalX).

From Expansion to Harvest

During the shale boom a decade ago, midstream MLPs borrowed heavily to build new projects. Today, the sector is in harvest mode. Capital spending is more disciplined, and expansions are typically pre-contracted with customers. With new pipelines in place and debt levels reduced, much of the cash coming in now drops straight to the bottom line. Free cash flow across the sector has climbed steadily in recent years, and balance sheets are healthier than they’ve been in decades.

Headwinds and Tailwinds

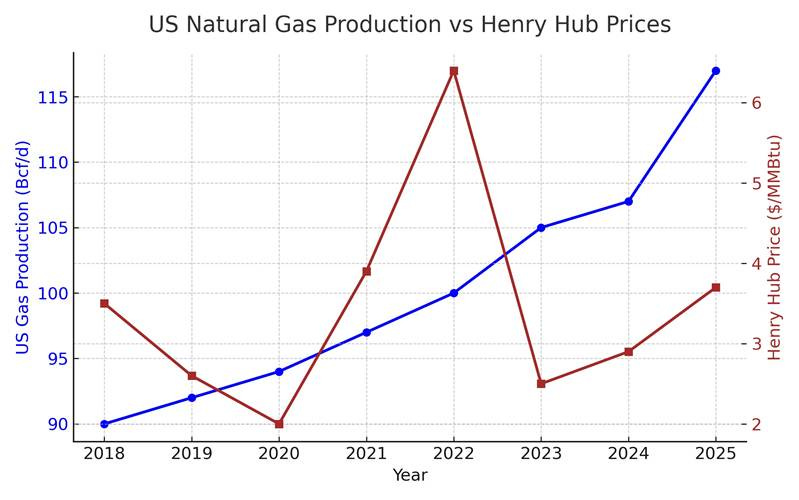

Commodity prices have been choppy. Oil spent much of 2023 in a slump, and natural gas prices fell after their 2022 spike. Yet U.S. production kept rising, reaching record highs in 2023 and it continues to grow in 2025. For midstream operators, volumes matter more than prices, and volumes remain robust. Global demand for gas is projected to keep climbing for decades, supported by rising consumption in Asia and the Middle East as well as domestic power generation needs. Every new LNG terminal or export pipeline effectively extends the toll road network, feeding midstream cash flows.

U.S. natural gas production is at record levels, while Henry Hub prices are projected to rise into late 2025 (EIA STEO).

Valuations Remain Attractive

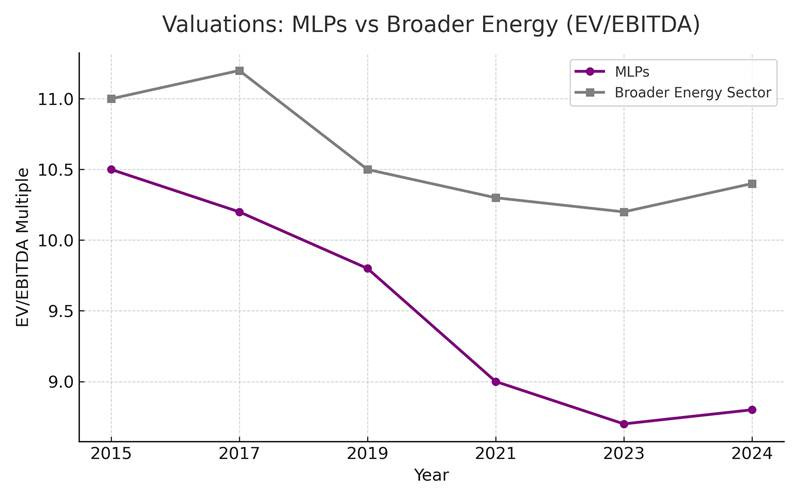

Another supportive factor is valuation. The MLP sub-group was trading at an EV/EBITDA multiple of about 8.8× estimated 2025 earnings, below its 10-year average of more than 10×. By comparison, the broader energy sector trades closer to 10.4×. This relative discount suggests investors have yet to fully price in the stability of midstream cash flows.

MLPs continue to trade at a discount to the broader energy sector on EV/EBITDA multiples (Hennessy Funds, AInvest).

The Bottom Line

Midstream MLPs are not immune to risk – a deep recession or regulatory shock would dent volumes and sentiment. Yet their combination of hard assets, contract-based revenues, and consistent free cash flow sets them apart in a volatile energy market. Investors looking for income and a measure of stability in the sector may find the pipelines running beneath their feet are still delivering, quarter after quarter.

About Us

Jay D. Hatfield is CEO of Infrastructure Capital Advisors and is the lead portfolio manager of the Infrastructure Capital Bond Income ETF (NYSE: BNDS), InfraCap Small Cap Income ETF (NYSE: SCAP), InfraCap Equity Income Fund ETF (NYSE: ICAP), InfraCap MLP ETF (NYSE: AMZA), Virtus InfraCap U.S. Preferred Stock ETF (NYSE: PFFA), InfraCap REIT Preferred ETF (NYSE: PFFR) and private funds. Each month Infrastructure Capital hosts a monthly economic webinar; you can sign up to attend by visiting our website www.infracapfunds.com (important disclosures can also be found on the website). For a prospectus please reach out to us or visit the links above for each respective fund.

DISCLOSURE

This information is not an offer to sell, or solicitation of an offer to buy any investment product, security, or services offered by Jay Hatfield, or Infrastructure Capital Advisors, LLC, (“ICA”) or its affiliates. ICA, will only conduct such solicitation of an offer to buy any investment product or service offered by ICA, if at all, by (1) purported definitive documentation (which will include disclosures relating to investment objective, policies, risk factors, fees, tax implications and relevant qualifications), (2) to qualified participants, if applicable, and (3) only in those jurisdictions where permitted by law. Jay Hatfield or ICA may have a beneficial long or short position in securities discussed either through stock ownership, options, or other derivatives; nonetheless, under no circumstances does any article or interview represent a recommendation to buy or sell these securities. This discussion is intended to provide insight into stocks and the market for entertainment and information purposes only and is not a solicitation of any kind. ICA buys and sells securities on behalf of its fund investors and may do so, before and after any particular article herein is published, with respect to the securities discussed in any article posted. ICA’s appraisal of a company (price target) is only one factor that affects its decision whether to buy or sell shares in that company. Other factors might include, but are not limited to, the presence of mandatory limits on individual positions, decisions regarding portfolio exposures, and general market conditions and liquidity needs. As such, there may not always be consistency between the views expressed here and ICA’s trading or holdings on behalf of its fund investors. There may be conflicts between the content posted or discussed and the interests of ICA. Please reach out to the ICA for more information. Investors should make their own decisions regarding any investments mentioned, and their prospects based on such investors’ own review of publicly available information and should not rely on the information contained herein. ICA nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. We have not sought, nor have we received, permission from any third-party to include their information in this article. Certain information contained in this document constitutes “forward-looking statements,” which can be identified by the use of forward-looking terminology such as “may,” “will,” “should,” “expect,” “anticipate,” “project,” “estimate,” “intend,” “continue” or “believe” or the negatives thereof or other variations thereon or other comparable terminology. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking statements.

The information contained herein represents our subjective belief and opinions and should not be construed as investment, tax, legal, or financial advice. Investors should consider the investment objectives, risks, charges, and expenses carefully before investing. Please read the prospectus carefully before investing. For more information about the Fund, Fund strategies or Infrastructure Capital, please reach out to Craig Starr at 212-763-8336 (Craig.Starr@icmllc.com). The Funds are distributed either by Quasar Distributors, LLC or by VP Distributors, LLC, an affiliate of Virtus ETF Advisers, LLC. ICAP, SCAP, and BNDS ETFs are distributed by Quasar Distributors LLC. PFFA, PFFR, and AMZA ETFs are distributed by VP Distributors, LLC an affiliated of Virtus ETF Advisers, LLC.