In a traditional dividend stock fund, investor's cash is used to buy a list of the highest yielding dividend stocks in whatever universe they are focused on. This has a few drawbacks because they tend to be very concentrated in mature and slow-growing sectors. Investors could ultimately lose out on substantial capital gains during bull markets.

They're also sensitive to interest rates. When rates are elevated, the dividend yields offered tend to seem unattractive by comparison and these funds have no easy means of enhancing yield. Plus, very high dividend yields may be a sign of distress for the company. This is what’s called a value trap and it can cause losses if companies pay too much cash to investors and it’s forced to eventually cut the dividend. Obviously, this is bad for the investor as they lose their dividend and the stock price declines at the same time.

The Infrastructure Capital Equity Income ETF (ICAP) addresses these issues by focusing on a strategy that utilizes a combination of dividend paying equities, call writing options and modest leverage.

Let's take a look at how the fund is designed and the team behind it.

Design and Strategy

ICAP was launched on December 11th, 2021. The fund is targeted at income investors looking to keep their broad equity market exposure while enjoying current income generation.

The fund invests at least 80% of its assets in dividend-paying large-cap securities, but that's where the similarity to traditional dividend funds ends. ICAP employs a three-layer approach to income generation:

Quality Dividend Selection: Instead of simply chasing the highest yielding stocks, the team focuses on companies with sustainable dividend policies and reasonable payout ratios. This helps to avoid the dividend traps mentioned earlier.

Covered Call Writing: The fund writes call options on its equity holdings to generate additional premium income. This strategy adds extra yield without requiring the companies themselves to pay higher dividends.

Strategic Leverage: The fund uses a modest amount of leverage, usually around 20-30% of fund assets. That allows the fund to potentially amplify returns from its dividend-paying positions.

This has combined to generate a current 30-day SEC yield of 6.55% (as of May 31, 2025)1, higher than what traditional dividend funds typically offer.

Performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Please call 800-617-0004 for performance data current to the most recent month end.

Portfolio Construction

ICAP's holdings reflect how the fund’s strategy can sometimes produce an atypical portfolio. The fund maintains an overweight position in financials, but also includes heavier allocations to real estate, energy and industrials. The top holdings include not just established names, such as Goldman Sachs, Citigroup and Morgan Stanley, but growth-oriented tech companies, such as Amazon and Broadcom.

This sector mix allows investors to participate in growth cycles that traditional dividend funds often miss while still generating substantial current income.

Management Team

The fund is managed by Infrastructure Capital Advisors' Jay Hatfield. Hatfield brings nearly three decades of experience providing sophisticated portfolio management strategies.

The fund takes a top-down approach that considers global macroeconomic factors, while maintaining a focus on individual fundamentals and valuation metrics. This active management is essential for implementing a more complex income enhancement strategy.

Performance Results

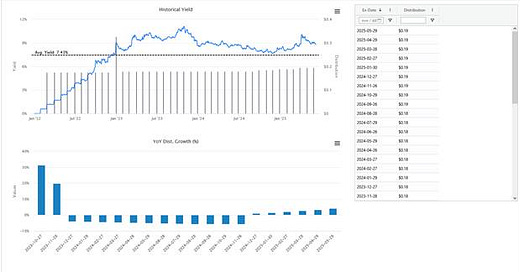

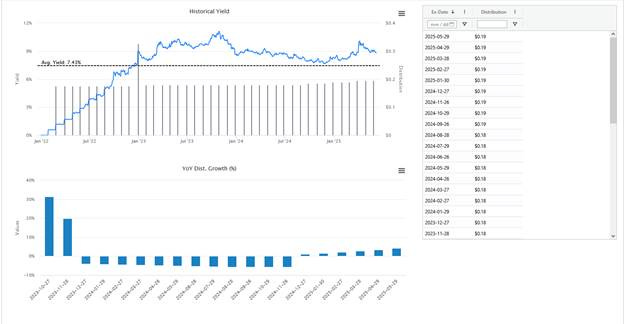

Since inception, ICAP has delivered an average annual return of 10.5% return, as of 5/31/25, while maintaining consistent monthly distributions. While this trailed the S&P 500's returns, the comparison misses that ICAP was delivering substantial income throughout the year via its 6.73% yield.

For income-focused investors, this trade-off between pure capital appreciation and current income generation can often make sense, particularly in volatile market environments where dividend income provides some cushion against price swings.

Investment Considerations

ICAP's high expense ratio1 may be initially off-putting to some investors, but it does reflect the active management and sophisticated strategies that are employed. Investors should also consider the fund's sector concentration and use of leverage & options as factors that can create different risk/reward profiles.

Overall, we feel that ICAP offers an alternative to both traditional dividend ETFs and more complex closed-end funds. If investors are looking for strategies to generate current income in today's low-yield environment while maintaining exposure to quality large-cap companies, ICAP may be considered as an option.

The fund's monthly distribution schedule and above-average yield make it relevant for income-focused investors who want to receive current cash flow from their portfolios rather than just long-term capital appreciation.

Sources:

1 as of May 31st, 2025, https://www.infracapfund.com/icap

About Us

Jay D. Hatfield is CEO of Infrastructure Capital Advisors and is the lead portfolio manager of the Infrastructure Capital Bond Income ETF (NYSE: BNDS), InfraCap Small Cap Income ETF (NYSE: SCAP), InfraCap Equity Income Fund ETF (NYSE: ICAP), InfraCap MLP ETF (NYSE: AMZA), Virtus InfraCap U.S. Preferred Stock ETF (NYSE: PFFA), InfraCap REIT Preferred ETF (NYSE: PFFR) and private funds. Each month Infrastructure Capital hosts a monthly economic webinar; you can sign up to attend by visiting our website www.infracapfunds.com (important disclosures can also be found on the website). For a prospectus please reach out to us or visit the links above for each respective fund.

DISCLOSURE

This information is not an offer to sell, or solicitation of an offer to buy any investment product, security, or services offered by Jay Hatfield, or Infrastructure Capital Advisors, LLC, (“ICA”) or its affiliates. ICA, will only conduct such solicitation of an offer to buy any investment product or service offered by ICA, if at all, by (1) purported definitive documentation (which will include disclosures relating to investment objective, policies, risk factors, fees, tax implications and relevant qualifications), (2) to qualified participants, if applicable, and (3) only in those jurisdictions where permitted by law. Jay Hatfield or ICA may have a beneficial long or short position in securities discussed either through stock ownership, options, or other derivatives; nonetheless, under no circumstances does any article or interview represent a recommendation to buy or sell these securities. This discussion is intended to provide insight into stocks and the market for entertainment and information purposes only and is not a solicitation of any kind. ICA buys and sells securities on behalf of its fund investors and may do so, before and after any particular article herein is published, with respect to the securities discussed in any article posted. ICA's appraisal of a company (price target) is only one factor that affects its decision whether to buy or sell shares in that company. Other factors might include, but are not limited to, the presence of mandatory limits on individual positions, decisions regarding portfolio exposures, and general market conditions and liquidity needs. As such, there may not always be consistency between the views expressed here and ICA's trading or holdings on behalf of its fund investors. There may be conflicts between the content posted or discussed and the interests of ICA. Please reach out to the ICA for more information. Investors should make their own decisions regarding any investments mentioned, and their prospects based on such investors’ own review of publicly available information and should not rely on the information contained herein. ICA nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. We have not sought, nor have we received, permission from any third-party to include their information in this article. Certain information contained in this document constitutes “forward-looking statements,” which can be identified by the use of forward-looking terminology such as “may,” “will,” “should,” “expect,” “anticipate,” “project,” “estimate,” “intend,” “continue” or “believe” or the negatives thereof or other variations thereon or other comparable terminology. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking statements.

The information contained herein represents our subjective belief and opinions and should not be construed as investment, tax, legal, or financial advice. Investors should consider the investment objectives, risks, charges, and expenses carefully before investing. Please read the prospectus carefully before investing. For more information about the Fund, Fund strategies or Infrastructure Capital, please reach out to Craig Starr at 212-763-8336 (Craig.Starr@icmllc.com). The Funds are distributed either by Quasar Distributors, LLC or by VP Distributors, LLC, an affiliate of Virtus ETF Advisers, LLC. ICAP, SCAP, and BNDS ETFs are distributed by Quasar Distributors LLC. PFFA, PFFR, and AMZA ETFs are distributed by VP Distributors, LLC an affiliated of Virtus ETF Advisers, LLC.