The S&P 500 Index closed at a new all-time high of 6,204.95 on June 30, 2025, prompting a familiar question among both retail investors and professional advisors: is the market now overvalued?

It’s a fair concern in any bull market, but especially today. Roughly 42% of the index is concentrated in just 15 stocks, a level of concentration that has led to growing unease about both valuation and lack of diversification.

With that in mind, here’s what the data says when you break things down across two of the most notable valuation metrics.

What the Buffett Indicator says

The Buffett Indicator is a simple but well-known way to assess how expensive the U.S. stock market might be.

Named after Warren Buffett, who once referred to it as “probably the best single measure of where valuations stand at any given moment,” the indicator compares the total value of the U.S. stock market to the country’s gross domestic product (GDP).

Historically, anything above 100% is considered overvalued, and 200% suggests the market is priced at twice the size of the economy.

In fairness, the market has often traded above historical norms for the last decade due to lower interest rates and more tech-driven profits. But this ratio still signals a rich market by almost any historical standard.

It may help explain why Berkshire Hathaway is currently holding over $350 billion in short-term U.S. Treasury bills. The Oracle of Omaha appears to be waiting for better valuations.

What the Shiller CAPE says

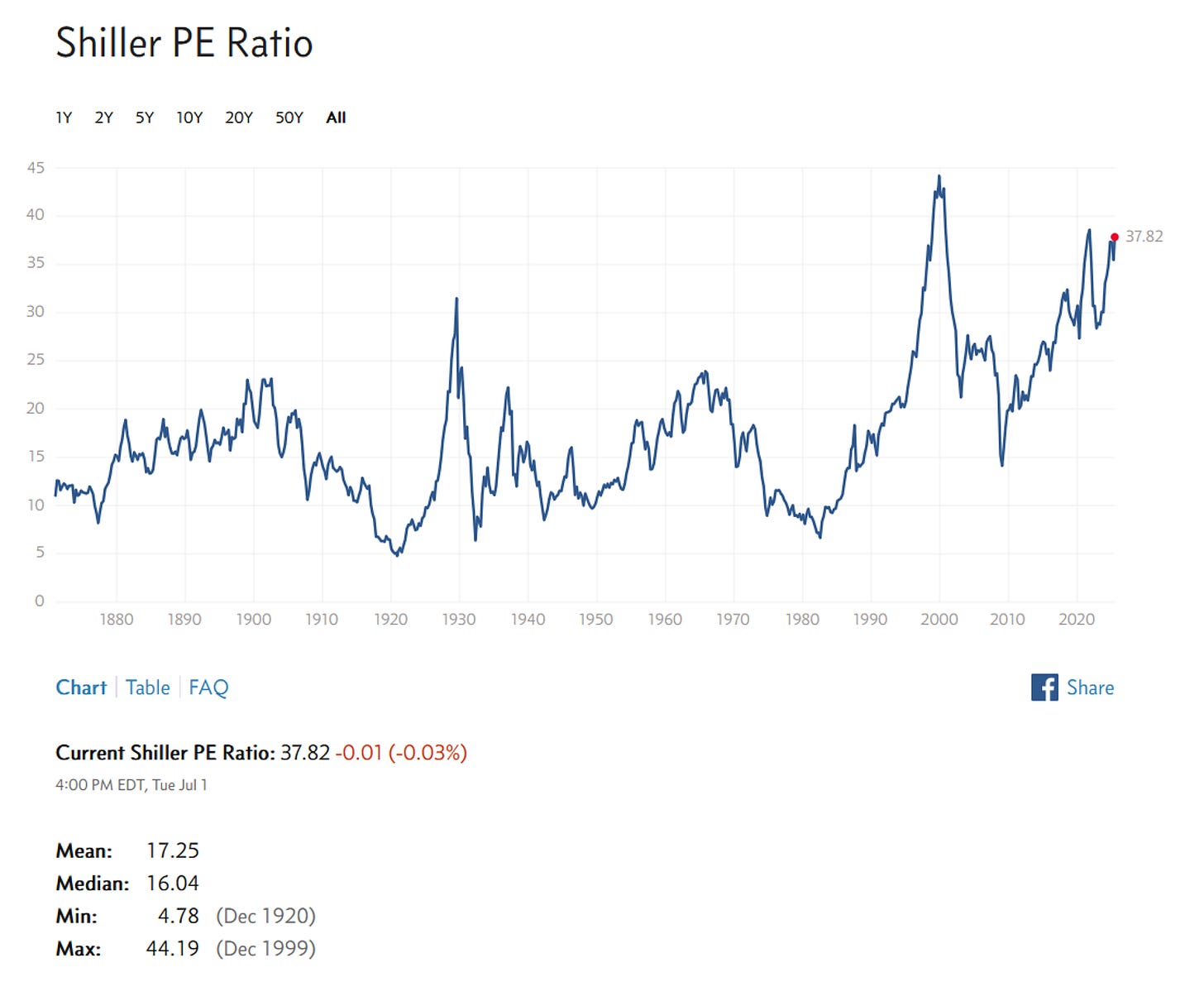

The Shiller PE Ratio, also known as the Cyclically Adjusted Price-to-Earnings (CAPE) Ratio was developed by Nobel Prize–winning economist Robert Shiller.

Unlike the standard PE ratio, which compares a stock’s price to its most recent 12 months of earnings, the Shiller PE smooths out volatility by using the average of inflation-adjusted earnings over the past 10 years. This gives a longer-term view of market valuation.

As of July 1, 2025, the Shiller PE stands at 37.82. That’s more than double its historical mean of 17.25 and significantly above its median of 16.04. Only once in history has it been higher, during the dot-com bubble in late 1999, when it peaked at 44.19.

Valuation-wise, this suggests that stocks are expensive relative to long-term fundamentals. The last few times the CAPE ratio was this elevated, future returns over the following decade were modest at best.

It doesn’t guarantee a crash, but it does imply that upside may be limited, and that caution is warranted at this stage in the cycle.

What can investors do?

Conventional wisdom says “stay the course.” But as the drawdown chart above makes clear, S&P 500 investors can and should expect periods of sharp declines, sometimes lasting months or years.

From the dot-com bust to the 2008 financial crisis to the COVID-19 selloff, drawdowns of 20% to 50% have been a recurring feature of investing in the S&P 500.

One approach to mitigate this is equal-weighting the S&P 500. This reduces concentration in mega-cap tech and skews exposure more toward mid-cap names.

The downside is cost. Equal-weight ETFs often come with higher expense ratios than traditional market-cap-weighted counterparts.

Another option is to selectively go beyond the benchmark's basket. Nothing stops investors from allocating directly to high-quality mid and small caps that aren’t heavily represented in the S&P 500.

A more tactical strategy could focus on quality and valuation metrics such as return on equity (ROE), free cash flow yield, earnings yield, and dividend growth consistency.

Screening for these traits can potentially help uncover companies trading at attractive multiples with the financial strength to weather volatility.

About Us

Jay D. Hatfield is CEO of Infrastructure Capital Advisors and is the lead portfolio manager of the Infrastructure Capital Bond Income ETF (NYSE: BNDS), InfraCap Small Cap Income ETF (NYSE: SCAP), InfraCap Equity Income Fund ETF (NYSE: ICAP), InfraCap MLP ETF (NYSE: AMZA), Virtus InfraCap U.S. Preferred Stock ETF (NYSE: PFFA), InfraCap REIT Preferred ETF (NYSE: PFFR) and private funds. Each month Infrastructure Capital hosts a monthly economic webinar; you can sign up to attend by visiting our website www.infracapfunds.com (important disclosures can also be found on the website). For a prospectus please reach out to us or visit the links above for each respective fund.

DISCLOSURE

This information is not an offer to sell, or solicitation of an offer to buy any investment product, security, or services offered by Jay Hatfield, or Infrastructure Capital Advisors, LLC, (“ICA”) or its affiliates. ICA, will only conduct such solicitation of an offer to buy any investment product or service offered by ICA, if at all, by (1) purported definitive documentation (which will include disclosures relating to investment objective, policies, risk factors, fees, tax implications and relevant qualifications), (2) to qualified participants, if applicable, and (3) only in those jurisdictions where permitted by law. Jay Hatfield or ICA may have a beneficial long or short position in securities discussed either through stock ownership, options, or other derivatives; nonetheless, under no circumstances does any article or interview represent a recommendation to buy or sell these securities. This discussion is intended to provide insight into stocks and the market for entertainment and information purposes only and is not a solicitation of any kind. ICA buys and sells securities on behalf of its fund investors and may do so, before and after any particular article herein is published, with respect to the securities discussed in any article posted. ICA's appraisal of a company (price target) is only one factor that affects its decision whether to buy or sell shares in that company. Other factors might include, but are not limited to, the presence of mandatory limits on individual positions, decisions regarding portfolio exposures, and general market conditions and liquidity needs. As such, there may not always be consistency between the views expressed here and ICA's trading or holdings on behalf of its fund investors. There may be conflicts between the content posted or discussed and the interests of ICA. Please reach out to the ICA for more information. Investors should make their own decisions regarding any investments mentioned, and their prospects based on such investors’ own review of publicly available information and should not rely on the information contained herein. ICA nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. We have not sought, nor have we received, permission from any third-party to include their information in this article. Certain information contained in this document constitutes “forward-looking statements,” which can be identified by the use of forward-looking terminology such as “may,” “will,” “should,” “expect,” “anticipate,” “project,” “estimate,” “intend,” “continue” or “believe” or the negatives thereof or other variations thereon or other comparable terminology. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking statements.

The information contained herein represents our subjective belief and opinions and should not be construed as investment, tax, legal, or financial advice. Investors should consider the investment objectives, risks, charges, and expenses carefully before investing. Please read the prospectus carefully before investing. For more information about the Fund, Fund strategies or Infrastructure Capital, please reach out to Craig Starr at 212-763-8336 (Craig.Starr@icmllc.com). The Funds are distributed either by Quasar Distributors, LLC or by VP Distributors, LLC, an affiliate of Virtus ETF Advisers, LLC. ICAP, SCAP, and BNDS ETFs are distributed by Quasar Distributors LLC. PFFA, PFFR, and AMZA ETFs are distributed by VP Distributors, LLC an affiliated of Virtus ETF Advisers, LLC.