There’s been plenty of chatter about the so-called “death” of the 60/40 portfolio. We wouldn’t go that far. But it’s hard to ignore how 2022 and much of the current macroeconomic environment has exposed some cracks in this once-unquestioned allocation approach.

That doesn’t mean it’s time to toss bonds out altogether. Instead, we think it’s worth rethinking how they fit into your overall strategy. Rather than relying on bonds solely as a risk-off hedge, they may now be better viewed as a yield engine within a broader total return framework.

Fooled by Falling Rates

Bonds have long been the go-to diversifier in traditional portfolio construction. The idea was simple: stocks provide growth, bonds provide ballast.

The negative correlation between the two meant that when equities tumbled, bond prices usually rose, helping stabilize portfolios and allowing for strategic rebalancing. It’s the backbone of mean-variance optimization and the premise behind “efficient” portfolios.

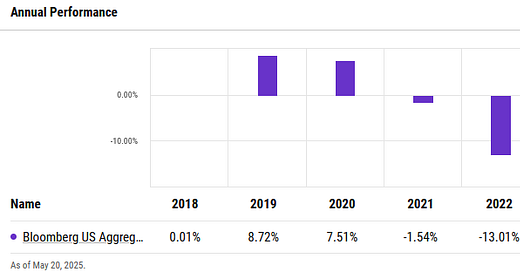

But what if that negative correlation wasn’t a timeless truth, but the byproduct of a one-off trend? The chart below offers a clear visual of why this may be the case.

Since the early 1980s, interest rates have mostly fallen. That created a tailwind for bond prices and cemented their role as a risk-off asset.

But once that trend reversed in 2022, the game changed. As interest rates surged, bonds and stocks both fell. The Bloomberg U.S. Aggregate Bond Index (the "Agg") finished 2022 down 13.01%, one of its worst years ever.

Many 60/40 proponents were caught flat-footed. The diversification they expected failed to materialize, not because the math was wrong, but because it was built on a foundation of falling yields most conveniently ignored.

That secular decline in rates masked the fragility of the bond/stock relationship. And with rate volatility still elevated and inflation risk still lingering, the bond market hasn’t returned to its old role with any conviction.

Now, this doesn’t mean bonds are obsolete. But it does mean they’re no longer the automatic counterweight investors once assumed.

What This Means for Allocators

The days of buying the Agg and calling it a day are over. Investors can’t afford to rely on the assumption that broad fixed income exposure will behave as it did during a 30-year secular decline in rates. The "just buy the basket" mindset now carries more risk than many realize.

Instead, we believe fixed income allocations require greater discretion. Rather than outsourcing decisions to a passive benchmark, allocators should consider the actual drivers of bond returns: term premium, credit premium, and liquidity premium. These are the levers that matter over a full market cycle, and they don’t move in lockstep.

That means building flexibility into the portfolio. Most bond ETFs that track the Agg or similar benchmarks are overweight Treasuries and financial issuers, while underweighting sectors like real estate and energy infrastructure. These sectors, REITs and MLPs, for example often issue debt backed by tangible, cash-generating assets. Ignoring them leaves return on the table.

We’re not saying there’s a clear replacement for the traditional risk-off asset, because there isn’t. But what’s becoming more obvious is that bonds may serve a different purpose in this environment. Instead of assuming they’ll hedge equity volatility, investors may be better off treating them as yield generators and part of the total return engine.

About Us

Jay D. Hatfield is CEO of Infrastructure Capital Advisors and is the lead portfolio manager of the Infrastructure Capital Bond Income ETF (NYSE: BNDS), InfraCap Small Cap Income ETF (NYSE: SCAP), InfraCap Equity Income Fund ETF (NYSE: ICAP), InfraCap MLP ETF (NYSE: AMZA), Virtus InfraCap U.S. Preferred Stock ETF (NYSE: PFFA), InfraCap REIT Preferred ETF (NYSE: PFFR) and private funds. Each month Infrastructure Capital hosts a monthly economic webinar; you can sign up to attend by visiting our website www.infracapfunds.com (important disclosures can also be found on the website). For a prospectus please reach out to us or visit the links above for each respective fund.

DISCLOSURE

This information is not an offer to sell, or solicitation of an offer to buy any investment product, security, or services offered by Jay Hatfield, or Infrastructure Capital Advisors, LLC, (“ICA”) or its affiliates. ICA, will only conduct such solicitation of an offer to buy any investment product or service offered by ICA, if at all, by (1) purported definitive documentation (which will include disclosures relating to investment objective, policies, risk factors, fees, tax implications and relevant qualifications), (2) to qualified participants, if applicable, and (3) only in those jurisdictions where permitted by law. Jay Hatfield or ICA may have a beneficial long or short position in securities discussed either through stock ownership, options, or other derivatives; nonetheless, under no circumstances does any article or interview represent a recommendation to buy or sell these securities. This discussion is intended to provide insight into stocks and the market for entertainment and information purposes only and is not a solicitation of any kind. ICA buys and sells securities on behalf of its fund investors and may do so, before and after any particular article herein is published, with respect to the securities discussed in any article posted. ICA's appraisal of a company (price target) is only one factor that affects its decision whether to buy or sell shares in that company. Other factors might include, but are not limited to, the presence of mandatory limits on individual positions, decisions regarding portfolio exposures, and general market conditions and liquidity needs. As such, there may not always be consistency between the views expressed here and ICA's trading or holdings on behalf of its fund investors. There may be conflicts between the content posted or discussed and the interests of ICA. Please reach out to the ICA for more information. Investors should make their own decisions regarding any investments mentioned, and their prospects based on such investors’ own review of publicly available information and should not rely on the information contained herein. ICA nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. We have not sought, nor have we received, permission from any third-party to include their information in this article. Certain information contained in this document constitutes “forward-looking statements,” which can be identified by the use of forward-looking terminology such as “may,” “will,” “should,” “expect,” “anticipate,” “project,” “estimate,” “intend,” “continue” or “believe” or the negatives thereof or other variations thereon or other comparable terminology. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking statements.

The information contained herein represents our subjective belief and opinions and should not be construed as investment, tax, legal, or financial advice. Investors should consider the investment objectives, risks, charges, and expenses carefully before investing. Please read the prospectus carefully before investing. For more information about the Fund, Fund strategies or Infrastructure Capital, please reach out to Craig Starr at 212-763-8336 (Craig.Starr@icmllc.com). The Funds are distributed either by Quasar Distributors, LLC or by VP Distributors, LLC, an affiliate of Virtus ETF Advisers, LLC. ICAP, SCAP, and BNDS ETFs are distributed by Quasar Distributors LLC. PFFA, PFFR, and AMZA ETFs are distributed by VP Distributors, LLC an affiliated of Virtus ETF Advisers, LLC.